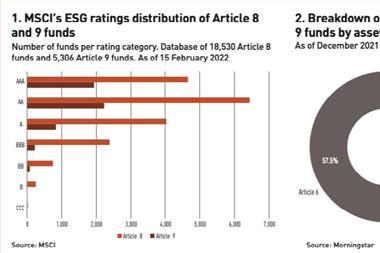

Six NGOs have jointly set out recommendations for minimum standards for so-called Article 8 and Article 9 products regulated by the EU’s sustainable finance disclosure regulation (SFDR).

Their move comes in anticipation of the European Commission initiating work on developing minimum criteria for Article 8 products, as it pledged to do in its renewed sustainable finance strategy plan from last year to address concerns about vagueness of definitions and greenwashing risks.

In a joint position paper released this week, the NGOs said that although the SFDR stipulated certain requirements that products need to meet to qualify for each category, “it remains far from constituting a much-needed sustainability standard for financial products”.

The SFDR was not intended as a classification scheme, but it has created product categories that have to a certain extent been taken up as labels.

The NGOs behind the paper are European consumer body BEUC, climate change think tank E3G, Finance Watch, ShareAction, Transport & Environment, and WWF.

Aleksandra Palinska, senior research and advocacy officer at Finance Watch in Brussels, said the NGOs and consumer organisations hoped to inform the Commission’s thinking about the mandate for the European Supervisory Authorities (ESAs) and provide food for thought for developing the substance of minimum criteria.

“We’re calling for minimum standards for ESG investments, building on the foundations set by the SFDR,” she said. “We think minimum criteria for Article 8-regulated products are not enough and that minimum standards for Article 9 are equally important.”

In the paper, the six organisations set out recommendations for minimum standards covering sustainability performance, engagement, exclusions, and financial instruments’ “capacity to effectively allocate capital to the real economy”.

On stewardship, for example, the NGOs suggested there should be a minimum level of engagement, such as a minimum number of meetings with a minimum proportion of companies within a fund.

Financial market participants marketing products as sustainable or with ESG characteristics should also be required to disclose a sustainability engagement policy including “measurable, time-bound sustainability objectives” and “a clear and robust” escalation strategy” if the objectives are not met.

With respect to products regulated under Article 9 of the SFDR, the group recommended that financial market participants be required to “demonstrate on a regular basis why and how their Article 9 products are claimed to have a positive impact”.

The SFDR provides for a review of the application of the regulation by the end of 2022, which points to a review being due in 2023. According to the NGOs’, “[t]his constitutes a perfect opportunity to insert the minimum criteria for Article 8 and 9 products”.

ESMA has already confirmed it will work be working with the Commission on minimum criteria for investment products falling under the Article 8 category. It indicated this work would take place this year.

IPE understands that the Commission is currently focused on the finalisation of the SFDR Regulated Technical Standards and Q&As and that work on the minimum criteria for Article 8 SFDR products will take place after this.

Read the digital edition of IPE’s latest magazine