In its 2023 progress report on how signatories are living up to their commitments, the Paris Aligned Asset Owners (PAAO) initiative has highlighted how its investor members are taking steps to achieve “real economy” emissions reductions, and engage with their asset managers on climate matters.

But it also singles out the use of carbon offsets as an area in need of more clarity, with respondents to its survey having often been unable to say for certain whether the companies they invested in used such methods to meet their own targets.

PAAO, which was set up in 2021, said the survey behind the new report – to which 42 of its total 56 signatories responded — showed various successes.

All reporting signatories demonstrated progress on achieving real economy emissions reductions through a combination of climate solutions, engagement and policy advocacy, it said.

The poll also showed there had been strong engagement with asset managers on climate-related financial issues, it said, adding that Paris-aligned policy advocacy showed asset owners were “walking the talk” on asking governments for a supportive policy environment.

On the topic of the initiative’s fourth commitment – that asset owners invest in long-term carbon removals, while acknowledging the necessity of offsets where there are “no technologically and/or financially viable alternatives to eliminate emissions” – the initiative said no poll respondents reported that offsets had been used at the portfolio level in 2023.

That was consistent with recommendations in the Net Zero Investment Framework used by PAAO signatories to deliver their climate commitments, it said.

“However, five respondents reported not being able to confirm whether offsets had historically been used at the portfolio level or not,” it added.

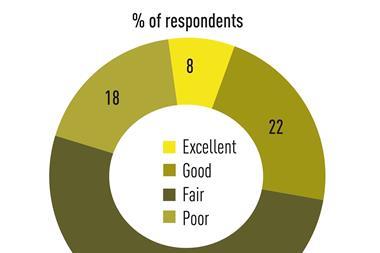

At the asset level, though – that is, by investees – the report’s authors wrote that 52%, or 22 respondents, reported offsets were used, with 13 saying they did not use offsets at the asset class level.

“However, for those two findings, data collection is challenging,” the report said, adding that the two findings had been based, in the first case, on investor assumptions that at least some of their assets were using offsets, and in the second case, perhaps on a lack of data available from investees.

“Evidently, it is difficult for asset owners to determine whether offsets are being used at an asset level, which makes it challenging for signatories to assure that offsets used at the asset level were only in situations where there are no technologically and/or financially viable alternatives to emissions,” the report said.

This issue clearly pointed to the need for further work and improved reporting, it said.

Commenting on the report overall, Stephanie Pfeifer, chief executive officer of the Institutional Investors Group on Climate Change (IIGCC) – one of the organisations behind the PAAO – and chair of the Paris Aligned Investment Initiative executive committee, said: “It’s positive to see this level of progress from asset owners, particularly the increasing investment in climate solutions.”

Some 20 respondents reported progress towards their climate solutions targets in 2023, according to the report, whose authors described that number as signalling “positive momentum among the signatory base”.

Read the digital edition of IPE’s latest magazine