All IPE articles in November 2022 (Magazine) – Page 2

-

Asset Class Reports

Asset Class ReportsPrivate markets: Venture capital investment beyond Sillicon Valley

A golden age of innovation opens opportunities for investors

-

Opinion Pieces

Opinion PiecesThe biggest test for private credit is upon us

Non-listed asset classes are sometimes touted as the weatherproof investment that can deliver positive returns no matter what, in both strong and weak economic environments.

-

Special Report

Special ReportESG: Leading viewpoint - rethinking sovereign bonds

Sovereign debt markets are not fit for purpose

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Diversification and dislocation in a place called dystopia

What happened to my free lunch? They told me that diversification was there for the taking, yet there has been no zig to my zag. They promised me downside protection, but all I see is red. They said liquidity was a benefit, but never mentioned the bid/ask spread. Welcome to dystopia in the era of dislocation.

-

Features

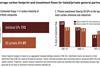

FeaturesThe rising influence of target-date funds on capital markets

One of the fastest growing markets in recent years is the US retirement market. Since 1995, the investment volume has increased six-fold, so that by the end of 2021, the market stood for almost $40trn (€40.1trn) AUM.

-

Special Report

Special ReportESG: Leading viewpoint - venture capital is embracing ESG - and SFDR is a major driver

Venture capital funds opting in to responsible investing

-

Asset Class Reports

Asset Class ReportsPrivate markets: Insurance risk seeks capital

Lloyd’s of London is looking to attract institutional capital to back its new insurance securitisation platform

-

Special Report

Special ReportESG: Leading viewpoint - why a carbon footprint does not measure what you think it does

The concept of ecological footprinting turns 30

-

Special Report

Special ReportESG: Interview - ShareAction’s Catherine Howarth on the cost of living crisis

“There’s going to be a good deal more scrutiny on the way the private sector behaves,” says the CEO of ShareAction, a London-based non-profit that coordinates investors and lenders on sustainability issues.

-

Features

FeaturesUK sovereign debt in turbulent waters as challenges remain

The buttoned-up Gilts market has never seen or done anything like it. Trusty stalwart of liability matching for defined benefit (DB) pension schemes, the blue-chip security has already poleaxed a British chancellor of the exchequer just a month in office, and has effectively done the same to prime minister Liz Truss.

-

Special Report

Special ReportESG: Prepping the next generation of listed companies on ESG

Investors are helping private companies understand their expectations before they go public

-

Opinion Pieces

Opinion PiecesLessons on LDI: learn from the Dutch cultural revolution

Around 20 years ago, UK occupational pension liabilities underwent a structural change. With assets weighted towards UK equities, still cashflow positive and open to new members and future accrual, liabilities were not too greatly discussed.

-

Features

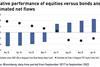

FeaturesFixed income, rates & currency: The return of extreme volatility

The emergency measures swiftly enacted by policymakers and central banks in March 2020, as we locked our communities, schools and businesses down, unsurprisingly created huge volatility in financial markets.

-

Special Report

Special ReportESG: Debate - Double or single materiality?

Two leading academics discuss the investment benefits of single versus double materiality

-

Asset Class Reports

Asset Class ReportsPrivate markets: Private debt investors stand their ground

Despite the likely rise in corporate default rates, private debt is expected to deliver for investors

-

Special Report

Special ReportESG: Private equity faces disclosure scrutiny

The CSRD will see a fourfold increase the number of corporates subject to sustainability reporting requirements, placing increased demands on private equity firms

-

Special Report

Special ReportESG: Interview - Julian Poulter of The Inevitable Policy Response on ‘disorderly transition’

It is hard to stay positive about the climate transition when listening to Julian Poulter. The head of investor relations at Inevitable Policy Response (IPR), the climate policy forecast run by the Principles for Responsible Investment, has been working on climate change since 2009, when he was CEO of the Asset Owners Disclosure Project. But while many green-finance veterans are giddy about the snowballing interest in net zero, Poulter is feeling less bullish.

-

Features

FeaturesDistributed work: a novel solution for displaced workers

What COVID has taught the world so dramatically is that knowledge-based companies have been able to function effectively with all their employees working remotely. Location suddenly no longer matters, and many employees have taken advantage of lockdowns to cross borders and work in places they wanted to be in, whether holiday resorts or with family.

-

Features

FeaturesSingle versus double materiality: ISSB faces inconvenient truths

Climate change denial has been a tough ask this summer. Forest fires raged across Europe, part of a London suburb caught light, and hurricane-force winds left a trail of destruction in southern Austria. The doom loop was complete when falling river levels left France’s nuclear power plants battling to produce enough energy to meet the demand for cooling.

-

Special Report

Special ReportESG: Leading viewpoint - private equity GPs are stepping up to the plate

Private equity firms can be a powerhouse for responsible investment

- Previous Page

- Page1

- Page2

- Page3

- Next Page