All IPE articles in November 2023 (Magazine) – Page 2

-

Special Report

Special ReportNatural capital and biodiversity: betting on disclosure for nature

The Taskforce on Nature-related Financial Disclosures (TNFD) has taken a pragmatic approach to developing its final recommendations

-

Features

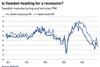

FeaturesFixed income, rates & currency: interest rates the big question

In August, when Fitch Ratings downgraded US debt from AAA to AA+, it cited an “erosion of governance” as one of the key reasons for its decision. September’s US government shutdown chaos will probably not have improved perceptions of US lawmakers’ proficiency to govern.

-

Analysis

AnalysisTrust will matter in light of market dominance of UBS in Swiss institutional business

One of the most important aspects of the downfall of Credit Suisse and the subsequent takeover by UBS is that loss of trust comes at the highest possible cost

-

Interviews

InterviewsPrivate equity managers are keeping pension funds happy – in most cases

The private equity industry faces significant pressures. IPE asked Nordic pension funds about their experience with this growing asset class.

-

Asset Class Reports

Asset Class ReportsCautious welcome for contentious SEC private equity rules

Representatives of private equity limited partners broadly support the SEC’s recent private fund adviser rules

-

Special Report

Special ReportCorporate reporting: UK pivots to a forward-looking view on climate transition plans

The Transition Plan Taskforce has given its final recommendations for climate transition plans. If adopted by the FCA they will lead to a step-change in reporting by financial institutions

-

Special Report

Special ReportInvestors’ climate lobbying turns from corporates to sovereigns

Engagement efforts with companies on climate issues have fallen short, and investors are now raising the stakes by lobbying governments on climate policy

-

Asset Class Reports

Asset Class ReportsRefinancings: private equity out in the cold

Activity has been disappointing due to macroeconomic headwinds and geopolitical tensions

-

Analysis

AnalysisThe pension consolidation masters: learning from the Netherlands

What can other countries learn from the Netherlands about pension fund consolidation?

-

Opinion Pieces

Opinion PiecesSEC cracks down on private equity and hedge funds

Pension funds, university endowments, insurance funds, and other institutional investors have long called for more transparency about their investments in private equity and hedge funds.

-

Special Report

Special ReportWho decides if investors can pursue sustainability objectives?

Pension funds must be prepared in case their members don’t care about sustainability

-

Features

FeaturesPricing the decline of democracy for investors

History does not progress in a linear way. Science, democracy, technology, arts, the economy and any other type of evolutive process advance and recede in chaotic movements, even though they ineluctably move towards progress. Those recessions and pull-backs often go unnoticed at first, at least to the casual observer. And yet, they end up profoundly sanctioned by all stakeholders including the economy, financial markets and investors.

-

Special Report

Special ReportIs there a role for ethics in ESG investing?

What if investors acknowledged that, sometimes, some things are just the right thing to do?

-

Opinion Pieces

Opinion PiecesRegulation of private markets is essential

The private markets industry is feeling the pinch. Private equity managers, in particular, are having a hard time raising capital and exiting investments. There are also questions about returns from recent vintages, as businesses struggle with inflation and a choppier trading environment. Meanwhile, private credit managers are pushing back loan repayments to safeguard returns as higher interest rates reduce borrowers’ ability to fulfil their obligations.

-

Special Report

Special ReportWhat should EU investors do if the Republicans win the White House?

Sustainability-minded investors should wake up to the challenge of right-wing populism and its threat to climate policy

-

Special Report

Special ReportPlenty left for EU sustainable finance policy to tackle

European policymakers have gone full throttle on sustainable finance over the past five years. Do they have the wherewithal to finish the job?

-

Special Report

Special ReportIs sustainable finance working?

Sustainability is now a top consideration for investors, but there is little evidence it is leading to a more sustainable economy

-

Special Report

Special ReportSustainable finance professionals take stock

IPE asked the responsible investment leads of top European asset owners a key question: has the ESG / green finance movement been effective in achieving a more sustainable economy? Here are their answers

-

Features

FeaturesRegulators set sight on private market fund valuations

The current waves of rising inflation and interest rates, economic uncertainty and market volatility may eventually be remembered as just a temporary setback for managers of unlisted assets. But the regulatory initiatives announced in recent months, following pressure from investors and the public, could bring about deeper changes to the buoyant private markets industry.

-

Opinion Pieces

Opinion PiecesIreland – future pensions tiger

Ireland stands a few policy steps away from the creation of a serious first and second-pillar pensions architecture that will improve the country’s international standing in terms of retirement provision.

- Previous Page

- Page1

- Page2

- Page3

- Next Page