All IPE articles in November/December 2025 (Magazine)

View all stories from this issue.

-

Special Report

Special ReportDemographics: Longevity fitness in the era of 100-year lives

As the ageing population grows, more and more people must become aware of the factors – financial, but also physical, cognitive and social – they will need to address to live well in retirement

-

Research

ResearchIPE institutional market survey: Global equities managers 2025

European institutional investors hold just shy of €2trn in global equities, up from €1trn in 2022. The assets held in global equities by European institutions have nearly doubled, no doubt thanks to the meteoric rise of equity valuations in the post-COVID years.

-

Research

ResearchIPE institutional market survey: Managers of Nordic institutional assets 2025

The assets managed on behalf of Nordic institutional investors have grown handsomely since the 2022 trough, increasing by almost 57%, while those managed on behalf of Nordic pension funds have grown by 50% over the same period.

-

Country Report

Country ReportNordic Region pension funds report 2025: ATP hits back at critics on risk structure

An academic discussion in a leading business journal has spilled over into a fully fledged debate with the fund’s leadership

-

Research

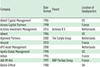

ResearchIPE institutional market survey: Private equity managers 2025

IPE’s annual survey of private equity firms, highlighting their assets under management, fund raising, and the areas in which they invest

-

Special Report

Special ReportTrends to watch in 2026: As stocks defy gravity, bubble fever speculation grows

Stocks seemed to have defied gravity this year, but the latest Bank of America (BofA) Securities Global Fund Managers survey shows that a record 60% of money managers canvassed believe global equities, including the US, are overvalued.

-

Special Report

Special ReportNet-zero goals in a post-COP30 world

The goals of the Paris Agreement are looking increasingly unachievable, leaving asset owners with a dilemma, writes Sophie Robinson-Tillett

-

Special Report

Special ReportUS courts award more than $4.7bn as securities class actions intensify

Tech and heathcare sectors dominated US class action cases in 2024

-

Special Report

Special ReportMichael Pedroni: “The path forward for an asset manager is to engage with authentic, consistent communication about what serves investors best”

Global asset managers are under more public pressure than ever, as policymakers in disparate regions demand that fund managers fulfil multiple and often conflicting roles.

-

Special Report

Special ReportInvestor class actions gain ground as ESG enters the frame

A more rigorous climate around environmental, social and governance disclosures and claims is leading to greater awareness of potential greenwashing

-

Special Report

Special ReportFrom Wells Fargo to Symantec: SEB AM’s definition of active ownership

In a 2025 report on global asset managers by ShareAction, SEB Asset Management (SEB AM) was ranked eighth out of 76 across responsible investment themes.

-

Asset Class Reports

Asset Class ReportsCase study: Pension Danmark focuses on AI, robotics and defence as it weighs up the value of active management

Erik Bennike, head of equities at PensionDanmark, explains the fund’s carefully chosen combination of active and passive management styles

-

Special Report

Special ReportJake Barnett: “Now is a powerful time for faith-based investors to advocate for what leadership looks like”

Wespath’s Jake Barnett talks to Susanna Rust about his vision for asset owner leadership in sustainable investing

-

Special Report

Special ReportThe Moravec paradox: AI and the future of jobs

The rise of artificial intelligence threatens many industries, but could it also see a levelling between ‘intellectual’ and more ‘hands-on’ jobs?

-

Asset Class Reports

Asset Class ReportsCase study: Varma aiming high while Looking for domestic growth

Varma is increasing its focus on unlisted companies in its home market

-

Special Report

Special ReportIMF sounds alarm on ‘shadow banks’

The growing connection between non-bank financial intermediaries and the global banking network is causing concern

-

Country Report

Country ReportAP funds merger: Sweden’s capital reshuffle

The reform of the country’s AP buffer funds has attracted both praise and controversy with questions remaining over governance, transparency and the preservation of expertise in unlisted assets

-

Interviews

InterviewsScenarios at the ready: How APG’s chief economist views political risk

Thijs Knaap, APG Asset Management’s chief economist, discusses political risk and how it could affect institutional portfolios

-

Analysis

AnalysisMilei’s Argentina finally shows signs of stuttering economic life

The president’s decisive victory in Argentina’s mid-terms indicates a mandate from the electorate for him to continue with his macroeconomic reforms

-

Interviews

InterviewsDecision time: Denmark’s Sampension discusses its strategy for European assets

Jesper Nørgaard, deputy CIO at Sampension, discusses whether it is prudent to maintain a large exposure to the US or re-allocate to European equities