All IPE articles in October 2021 (Magazine) – Page 2

-

Special Report

Special ReportPrivate equity: Focus shift brings turmoil to market

China’s focus on ‘common prosperity’ is boosting the importance of ESG factors and generating new opportunities as well as risks

-

Features

Pensions Insider: A tricky business: compensation for mismanagement

In the fourth of a series of articles aimed at empowering trustees, our insider discusses what happened in a case of fraud

-

Opinion Pieces

Opinion PiecesGuest Viewpoint: The climate is ripe for change

If there is to be a successful transition to a net- zero global economy, trillions of dollars need to be invested in renewable energy generation, electricity transmission and storage systems, and energy efficiency. The need is for fresh money. At scale.

-

Special Report

Special ReportInvesting in China

Investors the world over are thinking about China, from Soros to Mr and Ms Main Street. Our contribution to this theme (written before the Evergrande story broke) looks at both private and public equity, where managers are looking to align portfolios with China’s long-term investment needs. From a manager selection perspective, boots plus portfolio managers on the ground were an essential ingredient for successful portfolio positioning ahead of the July regulatory crackdown.

-

Special Report

Special ReportInterview: Diana Choyleva

Diana Choyleva, chief economist at Enodo Economics, says the battle for technological supremacy between the US and China will transform the global investment map

-

Features

FeaturesPerspective: Time to weigh collective DC

The UK finally legislates for a collective alternative to pure DC. But will employers be interested?

-

Special Report

Special ReportCommentary: A mile in Xi’s shoes

The shift from ‘trade war’ to ‘tech war’ between China and the US has forced China’s policy makers to deal with the country’s three key vulnerabilities

-

Special Report

Special ReportCommon prosperity reshaping equity markets

China’s focus is shifting to emerging industries in its drive to become a powerhouse of innovation

-

Opinion Pieces

Opinion PiecesConsultants’ education role in net-zero world

Investment consultants play a crucial role within the savings and investments arena. They provide strategic advice to asset owners (pension funds, sovereign funds, endowments, insurers, and others) relating to strategy, asset allocation, asset manager selection and – now more importantly than ever – investment beliefs.

-

Asset Class Reports

Asset Class ReportsThe next frontier for private credit

Global managers are making a strong case for investment in private credit issued by emerging market companies

-

Asset Class Reports

Asset Class ReportsEmerging market debt report

Our opening article in this report looks at emerging market private credit. In EMs there is a $100bn corporate funding gap with 90% of lending through banks. But we find EMD managers broadly cautious overall, particularly on China, with interviews conducted before the Evergrande story broke. Lastly, we look at Latin America, where investors encounter populism and social unrest but sustainability bond issuance is booming.

-

Country Report

Country ReportResearch: The French experience

Outsourcing to third-party managers and the push towards defined contribution pensions were key themes in a year made difficult by the COVID-19 pandemic

-

Opinion Pieces

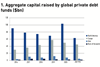

Opinion PiecesPension funds should seek fee reductions in private markets

Pension fund investment in non-listed assets has grown considerably since the 2008 global financial crisis.

-

Opinion Pieces

Opinion PiecesNotes on the Nordics: Moves may set up net-zero goal for GPFG

Two events have happened in quick succession that increase the chances of Norway instructing its huge sovereign wealth fund to push for net-zero greenhouse gas emissions in its investment portfolio.

-

Interviews

InterviewsHow we run our money: PMT

Hartwig Liersch (pictured), chief investment officer at Pensioenfonds Metaal & Techniek (PMT), tells Tjibbe Hoekstra how the largest private market pension fund in the Netherlands is looking to strengthen its investment policy to address the climate crisis

-

Special Report

Special ReportQ&A: A manager selector’s perspective

IPE asked RisCura’s head of research, Faisal Rafi, for a perspective on the wider implications of recent events in China

-

Interviews

InterviewsOn the record: Private markets

Three European pension funds discuss their views and strategies with regard to asset management fees, particularly in private markets

- Previous Page

- Page1

- Page2

- Next Page