All IPE articles in October 2022 (Magazine)

View all stories from this issue.

-

Country Report

Country ReportCountry Report – Pensions in France (October) 2022

The French pension system is in good health with a first-pillar pay-as-you-go system in surplus. But long-term forecasts are cause for concern, showing that the French state will have to raise expenditure on pensions from the current 13% to nearly 15% of GDP to maintain the system.

-

Features

FeaturesQontigo Riskwatch - October 2022

*Data as of 31 August 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Opinion Pieces

Opinion PiecesItaly’s far-right government won’t bring about great changes

The largely anticipated outcome of the Italian election was a strong mandate for the centre-right coalition. This would hardly be a new scenario, were it not for the fact that this time the chosen leader is Giorgia Meloni of Fratelli d’Italia (Brothers of Italy), a right-wing party with historical links with fascism.

-

Opinion Pieces

Opinion PiecesInternational Sustainability Accounting Standards Board: An insider view

Technical director Ravi Abeywardana highlights the challenges faced by the newly minted International Sustainability Standards Board and its staff

-

Features

FeaturesFixed income, rates & currency: Central banks act tough

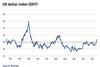

This year’s Jackson Hole Symposium, an annual high-level event sponsored by the Reserve Bank of Kansas, yielded relatively little policy news. But the fighting talk from the US Federal Reserve and others was striking. Fed chair Jerome Powell’s speech was markedly more hawkish than expected, while Isabel Schnabel, board member of the European Central Bank, referred to the need for central banks to act ‘forcefully’ because “both the likelihood and the cost of current high inflation becoming entrenched in expectations are uncomfortably high”.

-

Features

FeaturesAhead of the curve: Clearing up the ‘scaling’ confusion in carbon intensity

Today, a company’s carbon intensity is typically measured in one of two ways – scaling by revenue, or by EVIC (enterprise value including cash). The choice an investor makes can lead to differences in portfolio characteristics.

-

Features

FeaturesLGIM’s Michelle Scrimgeour: ambitions for growth

Michelle Scrimgeour and her executive team set out their strategic growth priorities in November 2020, a little more than a year after she had taken over as CEO of Legal & General Investment Management (LGIM). They agreed to grow the business by focusing on existing strengths: to modernise, diversify and to internationalise.

-

Special Report

Special ReportAsia investment: GIC enhances sustainability focus

A sustainability office now complements a sustainable investment fund that was launched in 2020

-

Special Report

Special ReportAsia investment: Japan’s GPIF assesses new strategy

World’s largest pension fund aims improve its allocation to ESG indices following a positive five-year track record

-

Special Report

Special ReportSpecial Report – Asia investment

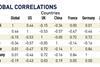

Investors steadily withdrew from emerging Asia equity markets this year, taking nearly $30bn out of the markets in the seven months to the end of July, with six consecutive months of outflows. Tech-oriented Taiwan and South Korea were most affected and India was not unscathed.

-

Special Report

Special ReportAsia investment: Focus shift brings turmoil to emerging Asia equities

Enthusiasm about Asian equities has cooled on the back of global recession risk, geopolitics and inflation

-

Special Report

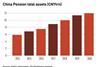

Special ReportAsia investment: China edges closer to a national pension plan

Foreign managers see opportunities in new US 401(k)-style pensions, with vast asset growth potential

-

Opinion Pieces

Trustees must assess impact of rate hikes

The Bank of England (BoE) has hiked its policy rate by 50bps to 2.25%, prioritising the fight against inflation over support for growth in its domestic economy. This interest rate increase has hit levels not seen since the end of 2008 but in line with a majority of economists’ consensus.

-

Book Review

Book ReviewBooks: How liquid are liquid assets?

Amin Rajan speaks to Pascal Blanqué about his latest book

-

Interviews

InterviewsInterview: Martin Præstegaard, ATP CEO

On the first day of September, Martin Præstegaard – who was installed little more than a month before as CEO of ATP – told journalists in the pension fund’s Copenhagen offices that ATP had made its biggest six-month investment loss ever.

-

Opinion Pieces

Opinion PiecesAustralia: Role for superannuation in nation-building

A new Labor government has set the scene for change in Australia’s growing superannuation industry to ensure that some of the country’s A$3.3trn (€2,3trn) savings pool is directed toward social housing and the energy transition.

-

Opinion Pieces

Opinion PiecesLetter from Berlin: The German way to supervise the EU Taxonomy

The German financial supervisory authority, BaFin, has chosen its own path to deal with the EU taxonomy – in particular when it comes to nuclear and gas.

-

Country Report

Country ReportFrance: The biodiversity reporting enigma

France’s financial institutions must report on biodiversity impacts but face a lack of corporate data push from pension reforms

-

Asset Class Reports

Asset Class ReportsEmerging market debt: China government bonds

The outlook for Chinese government debt is looking less attractive