All IPE articles in October 2023 (Magazine)

View all stories from this issue.

-

Country Report

Country ReportNetherlands pensions report 2023: Dutch funds plot move back into active investing

Several large Dutch pension funds are planning to move back into active management while others choose to go passive and further tweak their indices. But these two trends are not as contradictory as they may seem

-

Features

FeaturesInversion anxiety: what’s up with yield curves in 2023

For over half a century, each time the spread between US 10-year and three-month yields turned negative, indicating an inverted yield curve, a recession followed, sooner or later. In 2023, the yield curve has been more than just a little inverted.

-

Features

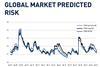

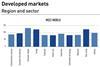

FeaturesQontigo Riskwatch - October 2023

*Data as of 31 August 2023. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

FeaturesIPE Quest Expectations Indicator - October 2023

The Russian war in the Ukraine is still stalling, with the prelude of the US elections coming closer. Trump’s self-destructive utterings keep his followers unmoved but do nothing to convince independents.

-

Opinion Pieces

Opinion PiecesLondon’s Lord Mayor Nicholas Lyons outlines his plan to raise £50bn from pension funds for UK growth assets

The road to hell is paved with good intentions. This aphorism can perhaps well describe the current state of the UK’s investment ecosystem. Despite Europe’s largest pension market at £2.5trn (€2.9trn), the UK economy has been starved of risk capital through a series of legislative and regulatory decisions.

-

Opinion Pieces

Opinion PiecesInvestors do not care about physical climate risks

One of the most pressing questions facing today’s climate research is whether climate change risks are reflected in stock prices. In a peer-reviewed study* recently accepted for publication in Journal of Banking and Finance, we found that investors only care about climate change risks when policymakers intervene, not about physical climate risks.

-

Opinion Pieces

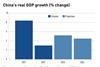

Opinion PiecesNBIM’s Shanghai exit: more than ‘operational’ adjustment’

When Norway’s sovereign wealth fund announced in September it was shutting down its only office in China, the move was bound to be seen as symbolic of the deteriorating relationship between China and the US and its allies. It also came at a low-point for investment in China, with foreigners having sold off a record CNY90bn (€11.5bn) of Chinese stocks in August, amid fears over China’s tensions with the West, its property crisis and weak post-COVID economic recovery.

-

Analysis

AnalysisUK pension industry reacts to government’s ambitious Mansion House Reform agenda

September saw the close of key pension reform consultations. Pamela Kokoszka and Liam Kennedy assess the proposals and some of the responses

-

Opinion Pieces

Opinion PiecesSustainable agriculture is a growing necessity and institutional investors play a key role

Investment manager PGIM stated in a research note in May: “From farm to fork, our global food system is vast, complex, inefficient and increasingly unfit for purpose.”

-

Country Report

Country ReportDutch pension funds evaluate member benefits and portfolio changes ahead of the transition

Early movers in the transition to a new Dutch pension system believe members could gain better benefits than under the old system

-

Opinion Pieces

Opinion PiecesPension funds can drive the AI revolution

Time and again we are reminded that the sole focus of pension funds should be on paying pensions. However, as stewards of capital, and because of their irreplaceable social function, they can aspire to be something greater than that. One outcome of pension funds’ decisions that is well within reach is positive technological innovation, including within the field of artificial intelligence (AI).

-

Special Report

Special ReportAI special report: Could investment management be transformed?

While many foresee a variety of roles for artificial intelligence, critics believe it has a limited role in crucial asset management activities

-

Special Report

Special ReportInvestors turn to AI for ESG data

Artificial intelligence has a potentially large role in sustainable finance, but the challenges are significant, making it hard for investors to take a clear view

-

Opinion Pieces

Opinion PiecesDon't expect Dutch pension funds to make a big move to alternative investments

It is often assumed that the upcoming pension reform in the Netherlands will lead pension funds to increase their allocations to alternative assets as their policy priorities will move from protecting their funding ratios to providing indexation for their members.

-

Features

SASB grapples with universal appeal

In the ever-evolving landscape of corporate sustainability, the Sustainability Accounting Standards Board (SASB) has long been the guiding star for the 90% or so of companies in the S&P500 that use the standards to chronicle their environmental, social and governance journey.

-

Special Report

Special ReportWho will be the asset management tech and data arms race winners?

Investment in technology and data is having a positive impact on asset managers’ revenue and market share, according to Casey Quirk

-

Opinion Pieces

Opinion PiecesAustralian super funds expand their global footprint

With billions of dollars flowing into its treasury each year, Australia’s largest industry super fund, AustralianSuper, is finding that it is rapidly outgrowing its own backyard.

-

Asset Class Reports

Asset Class ReportsLocal currency emerging market bonds are back in the spotlight

Partly thanks to the weakening of the US dollar, local currency emerging market sovereigns are now offering healthy yields, and should continue to perform well

-

Features

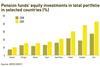

FeaturesResearch: Pension funds stabilise EU financial markets in good times and bad

A recent study investigated the potential stabilising role of pension funds in financial markets in the European Union from 2001 to 2017