Pension Fund Strategy – Page 43

-

News

NewsUSS employers urge scheme for fast conclusion of 2023 valuation

Employers ‘wish to be cautious and proportionate’ in making responses to USS’s improved funding position

-

News

NewsAlecta’s investment scandal claims another scalp as chair Ingrid Bonde quits

Bonde says she decided to resign because of ‘too much focus on me personally’

-

News

NewsPFA’s chief strategist sees market upturn despite mood-driven summer dip

Denmark’s largest commercial pensions firm ‘glass half full’ on late 2023 market outlook, said Choi Danielsen

-

News

NewsAldi Suisse Pensionskasse invests equity holdings through ESG funds

66% of second pillar members’ money still finances the fossil fuel industry, according to Climate Alliance

-

News

NewsPension industry warns of unintended consequences of LGPS pooling proposal

Isio suggests pools should be reformed before pooling mandate is enforced

-

Country Report

Country ReportNetherlands pensions report 2023: Dutch funds plot move back into active investing

Several large Dutch pension funds are planning to move back into active management while others choose to go passive and further tweak their indices. But these two trends are not as contradictory as they may seem

-

Country Report

Country ReportDutch pension funds evaluate member benefits and portfolio changes ahead of the transition

Early movers in the transition to a new Dutch pension system believe members could gain better benefits than under the old system

-

Features

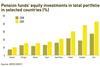

FeaturesResearch: Pension funds stabilise EU financial markets in good times and bad

A recent study investigated the potential stabilising role of pension funds in financial markets in the European Union from 2001 to 2017

-

Interviews

InterviewsTech and pensions are becoming inseparable

Pension funds are busy building state-of-the-art data management systems, which are an essential tool in delivering their objectives

-

Interviews

InterviewsIceland’s LV: Coping with disruption

Arne Vagn Olsen, CIO of Lífeyrissjóður verzlunarmanna (LV), Iceland’s Pension Fund of Commerce, talks to Carlo Svaluto Moreolo about strategy and the prospects for financial markets

-

News

NewsAkademikerPension sees positive return impact after shedding last oil/gas major

Danish occupational pension fund divests Italy’s Eni, excluding last large upstream oil and gas company in its portfolio

-

News

NewsAP2 helps German think tank develop portfolio tool to assess deforestation risk

In work funded by Californian philanthropists, Swedish national pensions buffer fund says publicly-accessible workflow will be tested on AP2’s listed equities

-

News

NewsThe People’s Partnership prepares to reform workplace proposition

It will start to price at a scheme level and has already started to reform its bulk transfer capabilities with a new specialist team

-

News

NewsGermany’s BVK reappoints Access Capital Partners for private equity

The scheme is also planning to hire a sustainability expert

-

News

NewsSOKA-BAU ploughs through strategic allocation targets

The scheme expects AUM growing to invest fresh money in all asset classes

-

News

NewsVarma poll shows nearly all its managers share its responsibility policy

Finnish pensions insurer finds half of firms it outsources investment to link remuneration to ESG outcomes

-

News

NewsSwiss pension funds increase equity, cut real estate investments

Schemes will likely continue to anchor Swiss and foreign real estate to investment strategies

-

News

NewsImerys Pension Scheme appoints Aon as fiduciary manager

Aon will provide implementation services alongside expert investment advice, including journey planning, to help scheme trustees make better decisions

-

News

NewsAPK Pensionskasse holds equity strategy, while eyeing private debt

APK plans to further develop its sustainable investment approach in the fourth quarter of this year

-

News

NewsBT Pension Scheme invests in Federated Hermes innovation fund

The growth focused programme complements the thematic Horizon private equity strategy that BTPS co-founded with Federated Hermes