Pension System – Page 122

-

Interviews

InterviewsExit interview: EIOPA’s Bernardino on industry defensiveness and where to take IORP II

The chair of EIOPA will be stepping down in March after 10 years in office

-

News

NewsAMX, DWS ‘shift paradigm’ with pooled funds stewardship solution

New service ‘to begin transition of voting power’ from managers to institutional asset owners

-

News

NewsAustrian occupational pensions market offers room for growth, execs say

The financial stability of the Austrian pension system raises the question of reforms, their impact on younger generations and the role of the industry to promote change

-

News

Experts cast doubt on ATP’s chances of success with new business model

“It’s a big step for ATP, but a small step for the members,” says Per Linnemann

-

News

Climate roundup: APG dumps KEPCO and eight others over coal pursuit

Plus: Aviva Investors announces escalation programme; Smart Pension makes net-zero pledge

-

Opinion Pieces

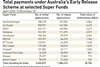

Opinion PiecesLetter from Australia: Early access genie escapes the bottle

In March 2020, as the Australian economy went into COVID-19 lockdown the government unlocked the national superannuation pool, seeking to ease the financial stress on individuals.

-

Opinion Pieces

Opinion PiecesInfra must adapt to meet pension goals

Looked at collectively, or even individually, the cashflow needs of Europe’s defined benefit (DB) and hybrid pension schemes are huge and potentially challenging given the scale of income generating assets needed to help service them.

-

Special Report

Special ReportSpecial Report: European Pension Funds’ COVID Response

We also analyse how public development banks are going beyond their traditional remit, with a focus on post-COVID recovery, tackling climate change and meeting the UN Sustainable Development Goals.

-

Opinion Pieces

Opinion PiecesGuest viewpoint: David Neal, IFM Investors

While COVID-19 continues to hit the global economy, governments are looking to infrastructure as a way to create future employment and sustain the eventual economic recovery

-

Interviews

InterviewsHow we run our money: Local Pensions Partnership

Chris Rule (pictured), CEO of the £19.7bn Local Pensions Partnership (LPP), speaks to Carlo Svaluto Moreolo about building an in-house investment management outfit

-

Country Report

Country ReportA long and winding road

COVID-19 joins the line of obstacles slowing Irish pension reform plans

-

News

NewsInvestment consultants offer guide to assessing their climate competency

‘Trustees need to know their advisers are on the front foot’

-

News

NewsAPG buys 40% stake in financial advisor

Prikkl to advise APG members on choices they have to make in the new DC-based pension system

-

News

Danish pension fund P+ saw record extra contributions in 2020

Labour-market fund reports members made DKK255m (€34.3m) of additional payments into scheme last year

-

News

APK Pensionskasse’s 4.2% 2020 returns outperform local schemes

Austrian Pensionskasse recovered from a -10% stand at the time of the equity market downturn in Q1 2020 to 2.55% at the end of the year

-

News

NewsWTW points to viable solutions to up occupational schemes’ appetite

According to the Alterssicherungsbericht 2020, the number of the people entitled to occupational pensions in Germany has lost momentum in recent years

-

News

Michael O’Higgins to step down as chair of LGPS pool LPP

Chair feels that, with two subsidiaries fully operational, ‘it is time to move on’

-

News

Russell Picot to join UK university scheme trustee board

Two directors rotating off at the end of January

-

News

NewsUK government presents pension fund climate risk governance, reporting regs

Requirements largely in line with August 2020 proposals but some helpful tweaks seen

-

News

Aberdeen City Council completes buy-in transaction with Rothesay

The transaction will insure the pension payments of 1,360 retired FirstGroup employees