- Save article

Special Report

Special ReportNorway: New buffer fund rules to boost returns

Providers of private guaranteed pension products are now allowed to take more risk in an effort to improve performancean

- Save article

Special Report

Special ReportNorway: Public-sector pensions consultation set for autumn

Occupational pensions could form part of a new review following last year’s Pension Commission report

- Save articleNews

Nordic roundup: PensionDanmark, PKA, Oslo Pensjonsforsikring

PensionDanmark, PKA to invest in developing countries’ agriculture

- Save articleNews

PKA makes first onshore wind investment with €350m Swedish project

Danish fund to take 30% stake in consortium with turbine manufacturer Vestas and energy company Vattenfall

- Save article

News

NewsNorwegian pension funds demand equality with insurers in solvency rules

Draft treats infrastructure, mortgage-backed bonds more strictly for pension funds

- Save articleNews

Oslo pension fund sees infrastructure returns dampen equity losses

Norway’s biggest municipal pension fund improves on narrow first quarter return

- Save article

News

NewsPeople moves: CEO of Icelandic pension fund Stapi to leave

Aon, Dimensional Fund Advisors, Gabler, Hymans Robertson, LPP, PKH, Schroders, Stapi

- Save articleNews

Head of Norwegian oil fund reveals personal shareholdings after criticism

Norges Bank Investment Management says comprehensive guidelines for staff remove all doubt

- Save article

News

NewsWednesday people roundup

Amundi, Financière de l’Echiquier, Norges Bank, PKH, Norwegian Association of Pension Funds, Keva, Varma, Oras Invest, AMF, Saminvest, Folksam, ATP, Bernische Pensionskasse, Avida International, Avenir Suisse, Spence Johnson, Financial Conduct Authority, Hymans Robertson

- Save articleCountry Report

The Nordic Region: Norway A concentrated equity market

Norway’s stock exchange, Oslo Børs, comprises of 203 issuers, of which 36 are foreign companies. The market-cap totals almost NOK1.5trn (€186bn) and the exchange saw six new listings in 2010.

- Save articleCountry Report

Norway: Seeking illiquidity

Åmund Lunde, chief executive of Olso Pensjonsforsikring, tells Rachel Fixsen how the fund has improved returns through an increased allocation to real estate and infrastructure

- Save article

- Save articleFeatures

Innovate to survive

As business becomes thinner and specialisation becomes crucial, Iain Morse reports on the Norwegian custody market

White papers

White papersBack to basics: a contrarian look at cyclicals in credit markets

The US bull run is the country’s longest on record. But we are in the latter stage of the global macroeconomic cycle and warning lights are flashing. We remain focused on corporate fundamentals, asking which high-quality cyclicals could successfully weather a slowdown.

- Save article

- Save articleFeatures

Back to basics

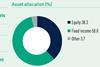

Pension funds are recognising that getting asset allocation right is an essential first principle. Rachel Fixsen reports

- Save articleFeatures

Gradually losing their inhibitions

As a Scandinavian country, Norway has been more exposed to the private equity culture than most other countries in Europe. And according to the latest figures from the European Venture Capital Association, Norway is slowly creeping up the European private equity rankings in overall terms. Last year, private equity investment ...

- Save article

- Save article

Special Report

Special ReportTop 1000 Pension Funds 2024: Pensions back at a sweet spot

Assets for the leading 1000 European pension funds grew by 8.7% year-on-year, reversing last year’s loss of 6.8%. This brings total assets back up to above their previous high water mark of €9.7trn in 2022’s research exercise. This year’s overall net gain in assets of €775bn is the largest since 2021’s increase of €810bn.

- Save article