All secondaries articles

-

News

NewsEQT to buy Coller Capital for up to $3.7bn to drive secondaries growth

The deal is expected to be mid-single-digit accretive to EQT’s fee-related earnings

-

News

NewsPGIM launches private credit secondaries push with $1bn target

The platform will focus on sourcing opportunities in direct lending as well as opportunistic credit areas, including mezzanine and special situations

-

Country Report

Country ReportItaly country report 2025: Pension funds step out of their comfort zone, diversify portfolios

While maintaining a domestic bias, Italian institutions are venturing into new asset classes to further diversify their portfolios

-

Asset Class Reports

Asset Class ReportsFive trends to watch in private credit

From the rise of secondaries and capital solutions funds to the trend of concentration among scale players, private credit is experiencing an intense and rapid phase of development

-

News

NewsGenerali and Partners Group target private credit secondaries

While MSCI and Moody’s move to standardise risk

-

Features

FeaturesSecondary markets and innovation boost private equity liquidity

Liquidity has reduced significantly in global private capital markets. Whilst private equity-backed IPOs are up this year, overall exit value is down by 66% and there is currently a large backlog of unsold assets, of which 40% are four years or older. The cumulative sum of unsold assets sits at $3.2trn (€2.9trn), according to Bain. Recent data from Preqin shows that capital called has exceeded capital distributed by $1.57trn since 2018, highlighting the lack of free capital in private markets.

-

Features

FeaturesPrivate credit secondaries come of age

Since the secondaries market came into existence, private equity has been the dominant asset class, but the tide is turning. It is finally time for private equity’s more youthful counterpart, private credit, to receive more of our attention. The private credit secondaries market borrows various elements from its older sibling, including best practices and deal structures, and it is now demanding the spotlight as awareness of the asset class increases.

-

News

NewsPrivate equity still too expensive – GSAM survey

Real estate is the least popular alternative asset class, with three in 10 investors looking to decrease their exposure

-

News

NewsWales Pension Partnership picks Schroders for £500m private equity mandate

The mandate will have a global investment focus, allocating across a number of industries including healthcare and technology

-

News

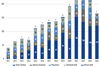

Pension funds expected to become largest sellers on private equity secondary market in H2

Interim sales of private equity investments worldwide have grown steadily from $40bn in 2015 to $132bn in 2021, says Bain Capital

-

News

NewsPrivate equity general partner-led deals could generate $200-300bn per year, says Schroders

Despite the current macro economic environment and geopolitical tensions the growth in secondaries transactions continues