All IPE articles in September 2021 (Magazine)

View all stories from this issue.

-

Special Report

Special ReportTop 1000 Pension Funds 2021: Powering on ahead

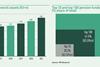

With a gross headline increase in pension assets of over €800bn – or 9.8% – Europe’s pension fund asset pools can be said to have powered through the COVID-19 crisis, riding the market highs to bank a solid recovery.

-

-

Country Report

Country ReportCountry Report – Pensions in the Netherlands (September 2021)

Dutch pension funds are hesitant to exclude companies or entire sectors from their investments universe and instead prefer to take the route of engagement, as we find out in our latest in-depth report on Dutch pensions. The report also covers how experiences from other countries can help illuminate the current Dutch pension reform, and analyses why the traditionally sleepy market for pension administration is undergoing unprecedented upheaval.

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - September 2021

The delta variant has caused a new COVID-19 wave in many places but it is different in character from previous ones. New hospital admissions are typically from among the unvaccinated. The average age of COVID patients has also come down significantly. In western Europe, the current wave seems largely under control, albeit at higher levels in the old EU member states.

-

Asset Class Reports

Asset Class ReportsUK Micro Caps: Below the line of abandonment

Kestrel Partners exploits a structural inefficiency in the UK’s micro-cap market

-

Opinion Pieces

Opinion PiecesViewpoint: Reform lessons from abroad

Pensions systems can be hard to compare but experiences from other countries can help illuminate the current Dutch reform process

-

Special Report

Special ReportBelgium: Government sets universal access task

The Vivaldi coalition wants to increase second-pillar coverage and boost contributions

-

Special Report

Special ReportRisk transfer: The accounting perspective

The effect on liabilities from an accounting point of view is an important factor when considering a buy-in or buyout

-

Opinion Pieces

Opinion PiecesPolicy underpins action

Politicians in a variety of different places understandably want to harness the capital of institutional investors. Dutch and UK politicians in particular have made no secret of their desire for local pension funds to invest for domestic ends.

-

Special Report

Special ReportDenmark: ATP gets green light to adjust risk-reward balance

New legislation clears the way for ATP to take on more investment risk

-

Country Report

Country ReportDC switch shakes up the admin market

A combination of new technology and pension reform has prompted alliances between existing players and the entrance of new players

-

Opinion Pieces

Opinion PiecesAfrica’s challenge for Europe

“Europe needs to create a new ‘spice route’ through Africa to the markets of Asia”. That was what Martin Schoeller, managing director of the Schoeller Group, a diversified services company with a focus on sustainability, told me in a discussion on the need for greater European investment in Africa.

-

Features

FeaturesPerspective - After Merkel: in search of a new model for pensions

Germany’s new government will feel the pressure to transform the pension system. Some parties have embraced new funded concepts and have put forward credible ideas

-

Special Report

Special ReportItaly: Reform season lies ahead

Italian policymakers are discussing further changes to the pension system but are reluctant to address the fundamental problems

-

Features

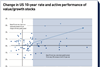

FeaturesAhead of the curve: Will rising rates see value stocks win?

There is growing global anticipation that central banks are likely to increase short-term rates. The spectre of inflationary pressure on longer-term rates looms large. What does this mean for value and growth stocks? Value might be expected to come up top and growth to lose out. But this is not the whole story. We examined stock returns during several historical periods of rate increases in the US and UK to see which factor would ultimately come out on top, and when.

-

Interviews

InterviewsOn the record: Aiming for carbon neutrality

Two Nordic pension funds discuss their ambitious climate transition strategies

-

Opinion Pieces

Notes from the Netherlands: Truly Paris aligned

A milestone was reached in July when the first Dutch pension fund announced its divestment from fossil fuels. Surprisingly, the fund in question was neither civil service scheme ABP nor healthcare fund PFZW, the two largest Dutch funds, both of which have the ambition to be leaders in sustainable and responsible.

-

Special Report

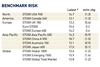

Special ReportUK: Funding challenges amid continued market uncertainty

The UK’s pension regulator emphasises the need for schemes to focus on long-term planning, transparency and risk management