All IPE articles in September 2023 (Magazine)

View all stories from this issue.

-

Features

FeaturesHow the AT1 bond market shrugged off the Credit Suisse debacle

On a late Monday evening in August, the Italian right-wing government unexpectedly announced a new 40% tax on banks’ ‘windfall’ profits derived by the higher lending rates. Shares in Italian banks tumbled, banking executives cried foul, and analysts poured scorn over the measure. The government, which was hoping to raise up to €3bn to help families and small businesses, backtracked shortly after, scaling back the tax.

-

Features

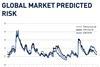

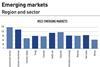

FeaturesQontigo Riskwatch - September 2023

*Data as of 31 July 2023. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

FeaturesIPE Quest Expectations Indicator: September 2023

US officials are talking up the Ukrainian advance towards Melitopol, a sign that all is not well. Contrary to expectations, the biggest problem is not the Russian air force, but land mines. Trump’s legal problems are as worrisome as his inexplicable lead among Republicans. US abstinence in the struggle against climate change is a potential cause for a major trade war as the EU realises it must expand its regulations on importing ‘dirty’ products to prevent a free rider problem undermining its climate efforts. In the UK, Labour’s lead over the Conservatives remains crushing, making it difficult to claim the government has a popular mandate.

-

Features

FeaturesResearch: The yin and yang of passive and active investing

Amin Rajan and Sebastian Schiele look at the complementary relationship between active and passive investment strategies

-

Interviews

InterviewsUSS: British universities adopt modern pension investment governance

Mirko Cardinale, head of investment strategy and advice at USS Investment Management, speaks to Carlo Svaluto Moreolo about the recent changes in the scheme’s governance framework

-

Opinion Pieces

Opinion PiecesConcerns over plans for Australian super funds to provide advice

In what some see as a controversial move, Australia’s Labor government under prime minister Anthony Albanese has reformed the nation’s financial advice industry, opening the door for industry superannuation funds to offer financial advice to millions of members.

-

Country Report

Country ReportFrance moves ahead with innovative climate reporting rules

A new French law could compel companies to disclose their climate plans

-

Special Report

Special ReportInvestors take a cautious asset allocation path on Asia

Investing in the region is far from straightforward, with benchmarking particularly tricky

-

Special Report

Special ReportHow investors are positioned to capitalise in APAC private markets

Strong fundamentals and a lack of correlation with western markets make the region particularly attractive

-

Features

FeaturesBritain’s LDI crisis: When things nearly fell apart

On 23 September 2022, Kwasi Kwarteng, the then UK chancellor of the exchequer, announced a £45bn (€52bn) package of tax cuts. The hand-outs, designed to please key voters, were the wrong gift at the wrong time. For several years, the Bank of England had been attempting to end quantitative easing and start putting a higher price on borrowing.

-

Interviews

InterviewsPaul Lorentz, Manulife Asset & Wealth Management: Canada to Europe, via Asia

Values are changing rapidly in the world of asset management. Leaders come and go, but perhaps less so than in the past, and loyalty to a company is increasingly appreciated by clients, as a sign of commitment and stability.

-

Special Report

Special ReportAsia Investment - Special Report

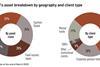

In this month’s special report on Asia, IPE’s private markets editor Lauren Mills analyses why global institutional investors are setting their sights on Asia. The combination of strong fundamentals and a lack of correlation with the European and North American economies make the region’s private assets particularly attractive. Investors are particularly hungry for infrastructure assets as well as the region’s fast-growing digital infrastructure.

-

Opinion Pieces

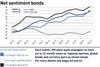

Opinion PiecesPrivate assets still a priority for pension fund investors

Investor sentiment towards private markets continues to be positive, despite the continuing challenges of higher interest rates and ongoing macroeconomic uncertainty.

-

Special Report

Special ReportSumitomo Mitsui Trust's Yoshio Hishida on Japan's unique position to attract investment

Yoshio Hishida, CEO of Sumitomo Mitsui Trust Asset Management, one of Japan’s largest investment managers, talks to Christopher Walker about his company’s focus on retail and attracting international capital

-

Features

FeaturesFossil fuel divestment is back in fashion

More and more asset owners are exiting oil and gas. Sophie Robinson-Tillett speaks to some about why, and how, they’re selling out of the sector

-

Features

FeaturesOpen-ended investment funds face up to the shadow banking dragnet

The debate over the systemic risk of non-bank financial institutions (NBFIs) – sometimes called shadow banks – is a recurrent theme but it has recently moved to the forefront thanks to tighter monetary policies, geopolitical risks and factors such as the UK’s LDI crisis. While regulators are assessing the threats posed, most market participants believe changes will not happen for years. For some, there are fears that largely unleveraged segments like open-ended investment funds could be unfairly targeted

-

Asset Class Reports

Asset Class ReportsRethinking net-zero equities benchmarks

The EU developed rules for climate benchmarks in 2019. After a surge in uptake, investor sentiment is already cooling

-

Opinion Pieces

Opinion PiecesEurope escaped the Great Retirement Boom but watch out for the crunch

Continental Europe appears to have largely escaped the trend known in the US as the ‘Great Retirement Boom’, where an economically comfortable cohort of 50 to 64-year-olds has retreated from work in the post-COVID period.

-

Special Report

India forms cornerstone of GIC’s BRIC portfolio

The Singaporean sovereign wealth fund has invested billions in the subcontinent since the 1990s and considers the country under-invested