All Special Report articles – Page 18

-

-

Special Report

Special ReportMiFID II: A threat to European sustainability?

MiFID II is unintentionally jeopardising the long-term objectives of ESG investors

-

-

Special Report

Special ReportPensions regulation in The Netherlands

Developments in the pensions landscape in The Netherlands

-

Special Report

Special ReportPensions regulation in Switzerland

Developments in the pensions landscape in Switzerland

-

Special Report

Special ReportPensions regulation in the UK

Developments in the pensions landscape in the United Kingdom

-

-

Special Report

Special ReportRegulation: SFDR put to the test

One year in and the verdict on the EU’s Sustainable Finance Disclosure Regulation (SFDR) is mixed

-

Special Report

Special ReportSpecial Report - Regulation

Europe’s flagship SFDR regime for ESG was never intended to become a fund-labelling framework. So as Susanna Rust also writes in this issue, it is a relief that the EU is now consulting on minimum requirements for Article 8 funds. In this Special Report, we look in some depth at how asset managers have embraced SFDR, taking in the broad reclassification exercise that has taken place to relabel existing funds, and the short-term risks of greenwashing. In the longer term, the hope is for much more standardisation and there are signs that this is already happening.

-

Special Report

Special ReportFrancesco Briganti: All’s well that ends well for PEPP?

Despite the remaining questions, the impact of the PEPP on European pensions could be positive

-

Special Report

Special ReportCase study: Readying PEPP for launch

The EU’s PEPP is like a shuttle aircraft, with the potential to carry individual savers across Europe. But its flight plan is detailed and complex, and admin providers play a key role in preparing PEPP for launch

-

Special Report

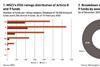

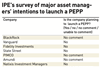

Special ReportPEPP: Few players on the starting line

In March, the European Union’s Pan-European Personal Pension Product (PEPP) framework comes into effect, amid doubts about the take-up by providers

-

Special Report

Special ReportThe jury is still out on PEPP: industry views

IPE asked some of the leading voices in the European pension industry to comment on the likelihood of success for the PEPP

-

Special Report

Special ReportSpecial Report – Pan-European Personal Pensions

From March, the European Commission’s vision of a simple, cross-border savings product becomes a reality with the launch of the Pan-European Personal Pension Product (PEPP). EU citizens will for the first time be able to channel savings into a long-term third-pillar product that is cost effective, simple and portable across borders.

-

Special Report

Special ReportISSB: A new body for sustainability standards

As it comes to life, the new International Sustainability Standards Board faces a complex path towards harmonisation of fragmented frameworks

-

Special Report

Special ReportSpecial Report – Sustainability & reporting

Increasing levels of ESG investing require greater transparency across the value chain, not least from companies. Enter the International Sustainability Accounting Standards Board, which will take shape this year and which is currently recruiting 11 inaugural board members.

-

Special Report

Special ReportSpecial Report – Prospects 2022 for European Institutional Investors

It’s all about inflation, stupid! Well, yes and no. While inflation is one of the top concerns raised by contributors to our vox-pop section on the economic outlook, growth and interest rates feature highly too. On the topic of inflation, EFG Bank’s Stefan Gerlach outlines why inventors should look at the underlying components of headline inflation numbers. We also look at the NextGenerationEU bond issuance programme, and the implications on the bond market. And energy specialist Cyril Widdershoven outlines the case for oil and gas as a transition play.

-

Special Report

Special ReportOutlook: New challenges await

Inflation rising above central bank targets in both the US and Europe threatens the global economy as it recovers from the shock of COVID-19. The impact on interest rates and growth is unclear, leaving investors with a dilemma on their hands. Should they continue to maintain a risk-on stance or raise their defences against potentially higher volatility throughout next year? At this time of uncertainty, IPE asked a selection of CIOs and strategists to comment about their asset allocation priorities for 2022 and beyond

-

Special Report

Special ReportNextGenEU: Towards a new euro yield curve?

Bonds designed to support member states hit hardest by the pandemic look set to become a new safe asset