All Special Report articles – Page 17

-

-

-

Special Report

Outlook: Can investors act alone on energy policy?

It may be up to governments to set the rules of engagement to achieve net zero

-

Special Report

Special ReportFour challenges for asset managers

Leading figures respond to key questions on ● Investment strategy ● ESG

-

Special Report

Special ReportOutlook: Future of hydrocarbons

The OECD remains critically dependent on Russian oil and gas – and finding alternative sources will be very hard

-

Special Report

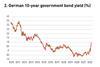

Special ReportOutlook: Good riddance to negative interest rates

The net effect of setting interest rates below zero is negative, and central banks may be wary of such policies in the future

-

Special Report

Special ReportOutlook: Investors grapple with inflation and rising rates

The asset allocation options available to institutional investors in such uncertain times are few

-

Special Report

Special ReportOutlook: The search for safe havens

Are we heading for stagflation and how should institutional investors prepare?

-

Special Report

Special ReportSpecial Report – Outlook

It’s hardly news that inflation is high on asset owners’ minds right now. We asked eight seasoned asset allocators, CIOs and strategists the same question: how do you rate the chances of stagflation? And what to do about it?

-

Special Report

Special ReportDriving change as the debate on impact evolves

It’s hard to believe, but this is IPE’s fifth annual special report dedicated to investing for impact: our first impact investing report was in 2018. What has changed since then? In some ways not much. We still have a debate about the credibility of claiming impact in public markets, where the narrative is all about stewardship in the form of engagement and voting, and we discuss the effectiveness of engagement versus divestment.

-

Special Report

UK Stewardship Code: a platform for impact

Investors and specialist managers could use the UK’s revised Stewardship Code to showcase intentionality and impact

-

Special Report

Special ReportCorporate lobbying comes under the spotlight

Companies are starting to respond to investors’ demands for transparent and consistent lobbying.

-

Special Report

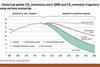

Special ReportConsigning fossil fuels to the past

How are asset managers supporting the shift away from fossil fuels in energy intensive sectors?

-

Special Report

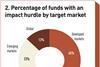

Special ReportData: focus on impact hurdles

An increasing number of impact funds link carried interest to impact goals. Asset owners can help by encouraging this trend

-

Special Report

Special ReportStrategy: The search for integrity and effectiveness

Investors are increasingly seeking real-world impact, but understanding of what that means and how it can best be achieved is still evolving.

-

Special Report

Special ReportTowards a sustainable portfolio theory

Applying monetary values to impacts would allow investors to direct capital better and assess opportunities for improved long-term returns

-

Special Report

Special ReportManager selection: Asset management operations under scrutiny

The role of outsourced operational due diligence on asset managers is becoming more prominent

-

Special Report

Special ReportManager selection: Market trends

Manager selection consultants are helping investors navigate the next stages of ESG integration

-

Special Report

Special ReportSpecial Report – Manager selection

With COVID-19 now under control, the business of selecting managers no longer has to deal with severe restrictions on travel and face-to-face interactions. However, the pandemic has taught investors and manager selection advisers some important lessons.

-

Special Report

Special ReportCSDR’s settlement penalties kick in

New regulations attempt to clarify and standardise securities settlement procedures