All Special Report articles – Page 14

-

Special Report

Special ReportESG: Leading viewpoint - rethinking sovereign bonds

Sovereign debt markets are not fit for purpose

-

Special Report

Special ReportESG: Leading viewpoint - venture capital is embracing ESG - and SFDR is a major driver

Venture capital funds opting in to responsible investing

-

Special Report

Special ReportESG: Leading viewpoint - why a carbon footprint does not measure what you think it does

The concept of ecological footprinting turns 30

-

Special Report

Special ReportESG: Interview - ShareAction’s Catherine Howarth on the cost of living crisis

“There’s going to be a good deal more scrutiny on the way the private sector behaves,” says the CEO of ShareAction, a London-based non-profit that coordinates investors and lenders on sustainability issues.

-

Special Report

Special ReportESG: Prepping the next generation of listed companies on ESG

Investors are helping private companies understand their expectations before they go public

-

Special Report

Special ReportESG: Debate - Double or single materiality?

Two leading academics discuss the investment benefits of single versus double materiality

-

Special Report

Special ReportESG: Private equity faces disclosure scrutiny

The CSRD will see a fourfold increase the number of corporates subject to sustainability reporting requirements, placing increased demands on private equity firms

-

Special Report

Special ReportESG: Interview - Julian Poulter of The Inevitable Policy Response on ‘disorderly transition’

It is hard to stay positive about the climate transition when listening to Julian Poulter. The head of investor relations at Inevitable Policy Response (IPR), the climate policy forecast run by the Principles for Responsible Investment, has been working on climate change since 2009, when he was CEO of the Asset Owners Disclosure Project. But while many green-finance veterans are giddy about the snowballing interest in net zero, Poulter is feeling less bullish.

-

Special Report

Special ReportESG: Leading viewpoint - private equity GPs are stepping up to the plate

Private equity firms can be a powerhouse for responsible investment

-

Special Report

Special ReportESG: Joined up thinking required

At last year’s Conference of the Parties, COP26, the financial sector stole the show.

-

Special Report

Special ReportESG: Leading viewpoint - write off ESG at your peril

ESG’s current travails are a mid-life crisis out of which something better and fitter will emerge

-

Special Report

Special ReportSpecial Report – ESG

Our report looks at the ESG through the prism of private markets, with coverage of SFDR and an interview with Anner Follèr, head of sustainability at Sweden’s national private equity investor AP6

-

Special Report

Special ReportESG: Taking a lead on private market ESG

Anna Follèr believes there is no asset class better suited to tackle ESG and sustainability than private equity.

-

Special Report

Special ReportESG: Spotlight falls on ESG executive pay incentives

Executive pay is increasingly tied to sustainability targets and investors want to ensure incentives are properly designed

-

Special Report

Special ReportIPE ETF Investor Survey 2022

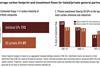

IPE’s first survey of investors focusing specifically on ETFs, conducted between mid-July and mid-August 2022, drew responses from institutional investors across nine European jurisdictions, of which 24% were invested in ETFs. Respondents were located in Belgium, Denmark, Germany, Italy the Netherlands, Portugal, Spain, Sweden and the UK.

-

Special Report

Special ReportETFs Guide 2022: Better tax treatment could prompt European ETF takeoff

First the good news: Globally, investment in ETFs continues to surge, with the first half of 2022 seeing the second highest inflows on record. The flexibility and ease of access they offer helped them play an instrumental role achieving the highest volume fixed income trading day being recorded in June, as $58bn of assets were moved from EM debt and high yield into government bonds (see p7). This helped cement ETFs’ position as an essential tool of the fixed income ecosystem.

-

Special Report

Special ReportActive ETFs: five myths debunked

Demand for exchange-traded funds (ETFs) has grown rapidly in Europe in recent years. While much of this growth has been driven by passive funds, research shows that investors are increasingly looking at active ETF strategies. Nevertheless, there are still lots of common misconceptions that are hindering the take-up of active ETFs. Here, we debunk the the most common myths about active ETFs.

-

Special Report

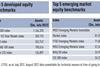

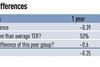

Special ReportGlobal emerging markets index investing: the case for an active component

Emerging market (EM) equities have an important role to play in broadly diversified institutional portfolios. Our data analysis shows that for investors who have a buy-and-hold strategy, an active component is needed to stay close to the benchmark because of trading costs and, more importantly, because of higher slippage costs by passive managers in downward markets.

-

Special Report

Special ReportActive ETFs: mixed fortunes

Tax efficiency and regulatory change have been the key drivers of the development of active exchange-traded funds in the US. As there are no similar tax benefits nor regulatory change in Europe, growth in this region has been limited.

-

Special Report

Special ReportAdding to the biodiversity protection toolbox

Biodiversity is intricately linked with economic growth and development. Since the industrial revolution ecosystems have been under constant threat with the advent of large towns, cities and industrial complexes. The rate of deterioration has accelerated over time and we are now destroying natural capital at an unprecedented rate, which will have long-term consequences for economies, societies and the planet.