All Special Report articles – Page 11

-

Special Report

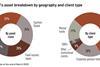

Special ReportInvestors take a cautious asset allocation path on Asia

Investing in the region is far from straightforward, with benchmarking particularly tricky

-

Special Report

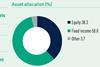

Special ReportHow investors are positioned to capitalise in APAC private markets

Strong fundamentals and a lack of correlation with western markets make the region particularly attractive

-

Special Report

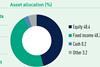

Special ReportAsia Investment - Special Report

In this month’s special report on Asia, IPE’s private markets editor Lauren Mills analyses why global institutional investors are setting their sights on Asia. The combination of strong fundamentals and a lack of correlation with the European and North American economies make the region’s private assets particularly attractive. Investors are particularly hungry for infrastructure assets as well as the region’s fast-growing digital infrastructure.

-

Special Report

Special ReportSumitomo Mitsui Trust's Yoshio Hishida on Japan's unique position to attract investment

Yoshio Hishida, CEO of Sumitomo Mitsui Trust Asset Management, one of Japan’s largest investment managers, talks to Christopher Walker about his company’s focus on retail and attracting international capital

-

Special Report

Special ReportAustria: Pension industry faces an indifferent government

Reforms look likely to be on hold until after federal elections in 2024

-

Special Report

Special ReportNorway: Public-sector pensions consultation set for autumn

Occupational pensions could form part of a new review following last year’s Pension Commission report

-

Special Report

Special ReportBelgium: First-pillar reform caps highest pensions

Federal government manages to work out a first-pillar agreement before the parliamentary recess

-

Special Report

Special ReportIceland: Government faces pension fund ire over housing bond controversy

Pension funds have welcomed a relaxation in foreign investment rules but would have preferred a more liberal regime

-

Special Report

Special ReportPortugal: Social security surplus funds pension boost

The Socialist government aims to reduce pensioner poverty but faces considerable demographic hurdles

-

Special Report

India forms cornerstone of GIC’s BRIC portfolio

The Singaporean sovereign wealth fund has invested billions in the subcontinent since the 1990s and considers the country under-invested

-

Special Report

Special ReportUK: Encouraging UK growth through consolidation

The UK government is pursuing plans to leverage pension assets to boost economic growth while generating best returns for members

-

Special Report

Special ReportFinland: Stabilising the level of pension insurance contributions

Government programme sets out to find ways to stabilise the level of pension insurance contributions over the long term

-

Special Report

Special ReportDenmark: Early retirement rules face further overaul

Arne, a new regime to allow workers in strenuous jobs to retire early may be merged with a more popular scheme

-

Special Report

Special ReportItaly: Government eyes pension reform despite lack of resources

Giorgia Meloni’s right-wing government wants to lower retirement age and secure retirement income for young workers, but it faces an uphill battle against inflation

-

Special Report

Special ReportFrance: Macron’s major pension reforms take effect

September sees the enactment of controversial retirement reforms passed by presidential decree earlier this year, bringing 42 occupational regimes together

-

Special Report

Special ReportGermany: Fighting for innovation

The three-party coalition faces important decisions in coming months to reconcile differences over its planned reforms to all three pillars of the pension system

-

Special Report

Special ReportSpain: New regulation introduces lifestyling

Government pushes through legislation package before elections last July

-

Special Report

Special ReportSupport data-driven decision-making. Access the Top 1000 European Pensions Dataset 2023

Gain access to the complete 2023 survey dataset providing detailed information on 1000 European Pension Funds. Whether you are a pension fund wanting to know how you measure up against your peers, an asset manager building a business, or a service provider in this multi-trillion Euro sector - our data provides the most authoritative picture of pension assets across the continent.

-

Special Report

Top 120 European Institutional Managers 2023 rankings

Total non-group assets managed for all types of European institutional clients – pension funds, insurance companies, corporates, charities and foundations – for the leading 120 managers in this business segment. Total assets are €11.5trn (2022: €14.4trn)

-

Special Report

IPE Top 500 Asset Managers 2023 rankings

Asset managers in our listing are ranked by global assets under management and by the country of the main headquarters. Assets managed by these groups total €102.6trn (2022= €108.6trn)