U.S. bond yields have been declining for four decades; why would the next decade be any different? - Jim Caron, Morgan Stanley Investment Management, explains

As fixed income investors, this is the question we get asked most often. If we had to pick a date, we would say 2024, but it may be sooner since market pricing tends to anticipate the future.

Of course, we can’t predict the future but let us explain. After all, U.S. bond yields have been declining for four decades; why would the next decade be any different? Well, there are several key differences.

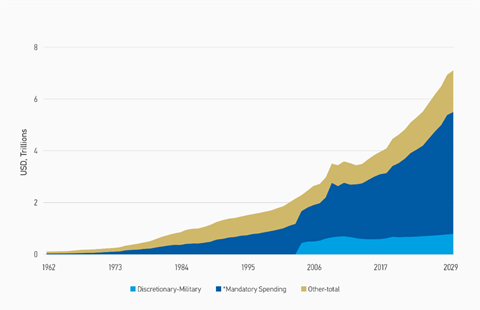

- Over the next decade, the vast majority of the ‘baby boomer’ generation will become eligible for government spending programs, funded by increased debt issuance (see Display 1).

- Monetary policy has pushed interest rates to extremely low levels, limiting how much lower rates can go without doing more harm than good.

- Fiscal stimulus may take the place of monetary stimulus during downturns in the economic cycle. Fiscal stimulus is a heavier burden to government debt valuation than monetary stimulus and therefore weighs heavily on bond yields.

The investment implication of rising yields is significant in terms of how investors use fixed income strategies to achieve both return and diversification. Fixed income will likely remain a large part of one’s asset allocation, but bond investors will need to think differently about how they use bonds to diversify their portfolio.

Why is 2024 so important?

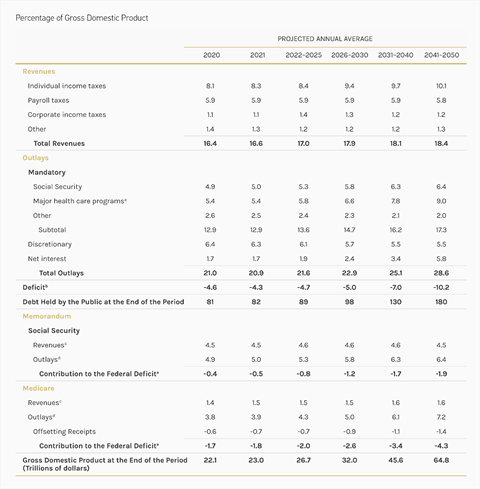

We selected this date as an important structural turning point for the bond market based on fiscal projections made by the Congressional Budget Office (CBO) published in January 2020 (see Display 2).

The year 2024 is the starting point at which the mandatory spending starts to accelerate due to an aging population. We refer to the so-called baby boomer generation as the significant demographic shift that will alter structural dynamics for US bond markets.

In 2026 the last of the baby boomers all become eligible for early retirement benefits at age 62 and by 2030 become eligible for full retirement benefits at age 66.

The percentage of outlays from mandatory versus discretionary government spending begins to accelerate between 2022 and 2025 and the peak in the percentage of the deficit due to mandatory spending is expected to be from 2026 to 2030.

Our goal is not to infer the accuracy of the CBO forecast, instead it is to show the potential trajectory and impact of mandatory spending heading our way based on aging demographics.

We do this to illustrate our point that the valuation of U.S. government debt may be adversely impacted. For instance, the CBO projects the ratio of U.S. debt to GDP as going from an average of 81% in 2020 to 180% on average between the years 2041 to 2050 and the fiscal deficit rising from 4.6% to 10.1% over the same time periods.

A rising deficit will put pressure on yields to rise

One can think of the debt to GDP as a leverage ratio, and the fiscal deficit as a default rate. If we think of this as a default rate, then a 10% deficit would suggest a high yield credit rating with high probability of default.

We do not believe the U.S. will default. The point here is that U.S. debt dynamics are becoming difficult and creditors of US government debt higher compensation.

Projections from the CBO are subject to change, but aging demographics are clearly putting adverse pressure on debt dynamics that may not allow for U.S. Treasury yields to remain at low levels in perpetuity.

A modern approach: using active strategies to help achieve return and diversification

High quality bonds have great diversification attributes and will remain key to a balanced portfolio.

Over the past 40-years, bonds have provided both return and diversification benefits to a balanced portfolio, because yields have trended lower. As a result, index-based strategies worked just fine.

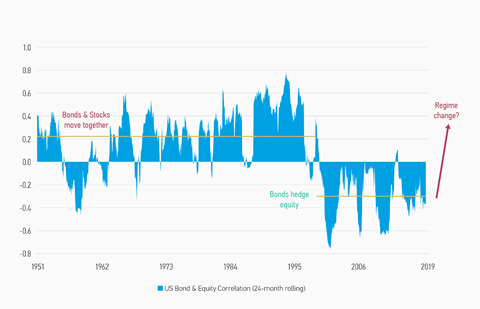

However, one needs to realize the key ingredient to this allocation strategy was the trend to lower interest rates. If that changes then bonds may not hedge equities because return correlations may rise.

This is likely to occur if bond yields rise but also if they just move sideways in a range. In other words, if bond yields stop consistently trending lower, then return and diversification benefits from risk-parity strategies fall.

In Display 3 we illustrate that it is historically common for bond and equity performance to have a positive correlation. In the past 20-years, using an extended 24-month rolling correlation, we see that bond and equity returns have enjoyed a negative correlation. But we believe this is changing.

The main driver of the rise in correlations may be that interest rates no longer trend lower supporting positive returns from fixed income.

Even if interest rates fluctuate in a wide range over the next several years, these will have the effect of increasing correlation between fixed income and equity making it difficult to achieve diversification in a balanced portfolio.

Another factor to note is rising and positive correlations are detrimental to a balanced portfolio when yields are rising from a low level. This is because bond returns can more easily turn negative when interest rates are low.

Think differently about how you use fixed income in your portfolio

If a fixed income strategy can be constructed in which return is less correlated and reliant on falling interest rates, then return and diversification from fixed income can be brought back to a balanced portfolio strategy.

One way to achieve this is by using actively managed and unconstrained fixed income strategies as part of your overall bond allocation. The goal is to earn more consistent returns, while simultaneously reducing correlation to the interest rate cycle.

Simply put, this is an alpha-based strategy to add alongside your beta driven fixed income strategy. We have observed that many investors are already trying to address this issue by reducing interest rate risk in their portfolio.

Investors have increased allocations to money market instruments or floating rate assets with near zero duration alongside traditional bond fund investments in order to reduce the overall duration risk.

The issue with this technique is that individual investors are using a limited tool set to help solve a complex problem. The risk with using money market instruments is if the economy slows and interest rates fall, then one does not achieve gains they may have otherwise received by owning longer duration bonds.

The risk with floating rate assets is that it they tend to be levered and exposed to credit, which in a downturn will not perform like longer duration bonds.

Conclusion

We believe that unconstrained and actively managed bond strategies, with proper risk and return characteristics, can be a solution. With these strategies, a manager can invest across a range of fixed income assets, better managing duration risk through dynamic asset allocation.

Managers can construct a long-only portfolio that adjusts to the economic cycle to help reduce the interest rate sensitivity of this strategy.

Jim Caron is the head of global macro strategies at Morgan Stanley Investment Management’s global fixed income team. He joined Morgan Stanley in 2006 and has 28 years of investment experience.