Alexandra Mihailescu Cichon, executive vice president at RepRisk, an ESG data science firm, says it’s time to bid ESG ratings farewell

While most investors say that ESG performance plays a pivotal role in investment decision-making, they are dissatisfied with the data available to them, according to the 2020 EY CCaSS Institutional Investor Survey. Two-thirds of investors (66%) cite data as the biggest barrier to ESG integration, according to a 2019 BNP Paribas Securities Services survey.

This disconnect has exposed the limitations of most ESG ratings and underlying reporting and highlighted the need for a different approach, one that explores more dimensions of ESG by looking beyond company disclosures and focusing on risks.

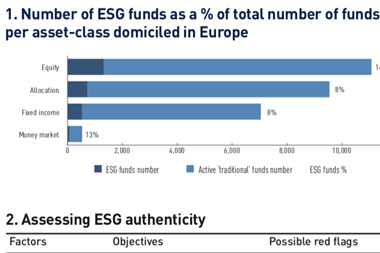

Sustainable investments have almost doubled over four years, and more than tripled over eight years, from $13.3trn in 2012 to $40trn in 2020, according to a Bloomberg study. ESG assets under management are predicted to top $53trn by 2025, the same study found.

Investors use ESG ratings throughout the investment processes, from pre-investment due diligence to portfolio construction and monitoring, to company engagement and value creation, but their analysis is only as good as the underlying data — and that data is increasingly coming under fire.

While the goals of ESG ratings are laudable – providing criteria for investors to measure progress and risks – the execution has fallen short.

Over the years, numerous rating agencies have created ESG ratings based on company self-disclosures, which can often result in potentially biased, incomplete, and unreliable findings. Self-reported data is opaquely one-dimensional and often does not account for ESG risks that have bottom-line compliance, financial, and reputational impacts for companies.

What’s more, due to industry consolidation over the past 5-10 years, the methodologies that ESG rating agencies use have changed a great deal. They can be thought of as “black-box methodologies” because there is so little transparency and no way to compare data.

The ambiguity of ratings

It’s hard to overstate this lack of consistency and clarity and the importance of transparency and reliability in ESG data. A well-known and now oft-cited study by MIT’s Sloan School of Management compared the ratings of five prominent ESG ratings agencies. The correlation among those agencies’ ESG ratings was on average 0.61; by comparison, credit ratings from Moody’s and Standard & Poor’s are correlated at 0.99.

In analysing the reasons for the divergence, researchers noted differences in scope (what’s measured), weight (the importance various factors are assigned) and measurement (measuring the same attribute using different indicators). The study noted that the information that decision-makers received was “relatively noisy” and contributed to “aggregate confusion.”

Further, companies and investors often feel like meeting ESG standards is a constantly moving target. While there is a broad-based effort underway to develop a universally accepted set of global sustainability reporting standards, the process is expected to be lengthy, complex, and arduous.

Going beyond ESG ratings

Given that there is so much aggregate confusion over a fundamental definition of what ESG is or isn’t, investors must look beyond ESG ratings. Bottom line: ESG ratings are an oversimplification.

Using publicly available sources and stakeholder information to identify and assess material ESG risks built on a rules-based and transparent methodology can deliver reliable, comparable, and actionable data. It provides investors with a clear use case and track record to inform business and investment decisions.

Investors and companies do not have the option of waiting for clarity.

As companies increasingly pivot their business models to integrate ESG factors and as the risks from ESG issues such as climate change mount, the need for robust and reliable data will only grow. Just as considering ESG factors was at one time revolutionary, it is time for the next chapter in the evolution of ESG, one that goes beyond the current ESG ratings paradigm.

The necessity of this approach is underscored by research that shows risk-based approaches to not only reduce risks and volatility, but to generate alpha and deliver outperformance.

A broad consensus, particularly over the past year, has emerged on the need to address ESG risk in investment portfolios. As the capital flowing into ESG funds multiplies, it is imperative that companies and investors move from the confusing and complex world of ESG ratings and towards a beautifully simple, risk-based approach.

Alexandra Mihailescu Cichon joined RepRisk in 2013 and is the executive vice president of sales and marketing. Over her tenure, she has established and led RepRisk’s globally distributed sales, partnerships, client relationship management, sales operations, and marketing and communications teams.