Amin Rajan

CEO of CREATE-Research

- Features

Research: The rise of climate investing in passive funds

COVID-19 is a devastating reminder of the fragility of life on Earth. It will be a key defining force of change in our age, alongside global warming.

Features

FeaturesAlecta: A tale of simplicity

At a time when defined benefit funds are under pressure globally, one Swedish fund offers a model of simplicity

Features

FeaturesClimate change and AI set to transform investing

As the new decade begins, it is becoming clear that climate change and artificial intelligence will reshape the future of investing

Analysis

AnalysisResearch: Back to basics will drive asset allocation

In the final article on a new report, Pascal Blanqué and Amin Rajan conclude that liquidity management has become vital as quantitative easing reaches a point of diminishing returns

Features

FeaturesResearch: Pension investors seem to be losing faith in quantitative easing

In the first of two articles on a new survey of pension plans, Pascal Blanqué and Amin Rajan find that unconventional monetary policy has taken a toll on pension funds

Features

FeaturesPassive investment: Dawn of a new banner theme

This follow-up article on the rise of index investing highlights how pension plans are seeking to promote stewardship among their index managers

Book Review

Book ReviewBook review: Achieving Investment Excellence

Fix asset allocation and the numbers will follow. This rule of thumb originated from an influential study published in 1986, which showed that 93.6% of variations in a portfolio’s returns are due to asset allocation policy.

Features

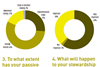

FeaturesResearch: Passive investors, active owners

The rise of index investing raises important question about ownership rights and governance

- Features

IORP II kick-starts consolidation

In the final article on a new survey, Pascal Blanque and Amin Rajan argue that IORP II is set to drive out structural inefficiencies in the EU pension landscape

Features

FeaturesResearch - Europe: Investors braced for an era of lower returns and higher volatility

In the second of three articles on a new survey, Pascal Blanque and Amin Rajan argue that pension investors are adapting to challenges that go beyond the realms of a maturing business cycle

- Features

How do investors view the future of the EU economy?

Cyclical recovery or secular healing? That is the big question behind the European Union’s economic bounce after its ‘lost decade’ – the toughest period since the founding of its predecessor, the European Economic Community, in 1957.

- Features

Passives will move centre stage in the core-satellite model

Like digital brands, passive products will continue to benefit from the network effect, in which a product or service is perceived as more worthwhile the more people use it. The classic example is the telephone: a growing user base enhances the value to each subscriber.

- Features

Research: Passive funds extend their reach

In the second article on a new study, Amin Rajan and Simon Klein argue that momentum towards passives is unlikely to ease during this decade, but that its composition will change

Special Report

Special ReportAlternatives: Digitise or jeopardise

Alternative investment managers face a stark choice as digitisation increases

- Features

Long-Term Investing: Regaining the virtues of common sense

This concluding article on a new survey argues that pragmatism dominates asset allocation

- Features

Asset managers prepare for a digital future

A three-way chain reaction between technology, regulation and demographics is driving a new transformation

Special Report

Special ReportTop 400: Business models - No turning back

Familiar set-ups in asset management are becoming obsolete in the face of Darwinian forces

- Features

Pension Investing: Distortions hasten innovation

In this third article on a new survey, Pascal Blanqué and Amin Rajan show that as old methods of investing have lost relevance in a landscape distorted by quantitative easing, a search for new ways has intensified