All IPE articles in August 2025 (online)

View all stories from this issue.

-

Features

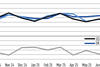

FeaturesIPE Quest Expectations Indicator – August 2025

Trump’s attempts to undermine international trade and the US Federal Reserve are turning analysts against US assets, while good news out of Europe reinforce the case for appreciation of European assets

-

Opinion Pieces

Opinion PiecesHow building African pensions could unlock local capital markets development

The 6th annual conference of the Africa Pensions Supervisors’ Association (APSA), held in Marrakesh in July, offered invaluable insights into the scale of the challenges and the opportunities of building pension systems in Africa

-

Analysis

AnalysisFixed income, rates, currencies: uncertainty sends US stocks out of sync with bonds and currencies

Tariff-led recession fears have eased, supporting risk assets, but bond and currency markets are in ‘wait-and-see’ mode

-

Analysis

AnalysisChart watch: positive US GDP forecasts overshadowed by tariff unpredictability

Economists expect a benign macroeconomic environment, but all is predicated on the fickleness of US policy

-

Analysis

AnalysisIPE Netherlands Briefing: Dutch funds reverse course on active management

Plus: SamCo, the asset manager of most Shell pension funds, will be wound down, and Goldman Sachs Asset Management will be fiduciary manager of six Shell schemes

-

News

NewsM&G changes climate strategy to prioritise asset alignment and engagement

The 2025 target moves beyond reducing portfolio emissions to assess climate resilience of portfolio companies

-

News

NewsEIOPA flags persistent market risk for IORPs amid stable overall outlook

EIOPA’s latest dashboard shows overall risk assessment for EU occupational pension funds at medium level, but warns of high market and asset return risks

-

News

NewsNBIM chief Tangen reveals how he kept his job amid Elon Musk text furore

CEO of Norway’s SWF publishes book on leadership, compiling podcast interviews

-

News

NewsSweden’s Kåpan brings back retired CEO to hold fort after Giertz exit

Chair says Gunnar Balsvik ‘will contribute to stability, continuity and secure leadership’

-

News

NewsPensionsEurope plays down need for scale interventions in IORP II review

Industry association to go into more detail in response to the Commission’s targeted consultation on supplementary pensions

-

News

NewsDow Chemical pension fund gears up for buyout

Several insurance firms active on the Dutch buyout market have shown interest in a buyout of the €2.1bn pension fund of US chemicals giant Dow

-

News

NewsDenmark’s pensions lobby teams up with banks to firm up defence financing

IPD and Finance Denmark launch new partnership as a coordinated effort to bolster cooperation with government, authorities on investment and financing for defence

-

News

NewsISS Stoxx to buy geospatial analytics firm

ISS says institutional investors showing greater need for geospatial data and enhanced risk analytics

-

News

NewsPRI launches private debt stewardship guide with Redington

PRI CEO David Atkin says lenders ‘face significant barriers to stewardship’ with private debt ‘that do not necessarily exist elsewhere’

-

News

NewsAsset managers continue to raise the bar on sustainable investing – survey

But Isio sees plenty of work left to do at fund level

-

News

NewsNational Grid UK Pension Scheme secures £900m buy-in deal

Transaction takes the pension fund’s total liabilities de-risked with Rothesay to £4.5bn

-

News

NewsACCESS partner funds on the look out for new pooling arrangement

The pools are expected to select partners ahead of the final decision deadline of 30 September 2025

-

News

NewsPGIM’s middle market direct lending fund reaches $4.2bn final close

The fund provides senior secured financing to middle market companies across North America, Europe, and Australia

-

News

NewsMMC UK fund in £1.9bn in bulk purchase annuity deal with Standard Life

The buy-in deal covers 6,500 members of the Sedgwick Section of the MMC UK Pension Fund

-

News

NewsRailpen picks Neuberger Berman for securitised credit mandate

The mandate primarily invests in securitised debt securities, including collateralised loan obligations, asset-backed securities and mortgage-backed securities