All auto-enrolment articles – Page 4

-

Opinion Pieces

Opinion PiecesIreland – future pensions tiger

Ireland stands a few policy steps away from the creation of a serious first and second-pillar pensions architecture that will improve the country’s international standing in terms of retirement provision.

-

Features

FeaturesResearch: Pension funds stabilise EU financial markets in good times and bad

A recent study investigated the potential stabilising role of pension funds in financial markets in the European Union from 2001 to 2017

-

News

NewsThe People’s Partnership prepares to reform workplace proposition

It will start to price at a scheme level and has already started to reform its bulk transfer capabilities with a new specialist team

-

News

NewsUK automatic enrolment extension bill granted Royal Assent

It will ‘dramatically improve financial resilience in retirement for young people, women and lower earners,’ says DWP

-

Special Report

Special ReportIreland: All systems go for national auto-enrolment

Irish government aims to launch auto-enrolment retirement system in 2024

-

Special Report

Special ReportUK: Encouraging UK growth through consolidation

The UK government is pursuing plans to leverage pension assets to boost economic growth while generating best returns for members

-

News

NewsLifeSight reaches €2bn AUM in Ireland ahead of auto-enrolment arrival

’Employers are preparing for big reforms around pensions, with the expected arrival of auto-enrolment early next year’

-

News

NewsUK roundup: DB scheme transfers see significant fall in quotations

Plus: PLSA recommends policy measures to reduce risk of over-saving; Smart Pension partners with Punter Southall

-

Opinion Pieces

Opinion PiecesLessons learned from Berlusconi’s pension reforms

To some, the death of Silvio Berlusconi on 12 June this year, is the end of an era for Italian politics. Berlusconi was the longest-serving prime minister in the history of the republic and a highly controversial figure, at home and abroad. He can be described as the first modern European populist leader.

-

News

NewsIreland moves step closer to auto-enrolment setup

There will be a separate tender for investment services later in the year

-

News

NewsUK master trusts don’t survey members on risk appetite

‘Risk considerations are not driven by member views but by expert opinion,’ says Hymans Robertson

-

News

NewsPLSA pinpoints UK investment potential for pension funds

The association expects the scale and distribution of assets across the pensions sector to alter substantially over the next decade

-

News

NewsUK gender pensions gap at 35%, according to DWP

‘Vital first step in tackling profound gender inequalities in pensions,’ says LCP

-

News

NewsPension professionals increasingly dissatisfied with pensions policy, says PMI

However, there is scope for improvement, according to the Institute

-

News

NewsUK roundup: British Steel Pension Scheme in £2.7bn buy-in deal

Plus: DWP opens auto-enrolment consultation for defined benefit schemes; Direct Line Group Pension Trustee picks LifeSight as master trust provider

-

News

NewsFuture of UK pensions ‘looks risky’, says IFS as Pensions Review is launched

The Pensions Review will produce a series of detailed reports over the next two years on these challenges facing future generations of pensioners

-

Interviews

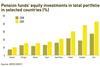

InterviewsPZU TFI: Building the future of Polish pensions

Marcin Żółtek (pictured), CEO of PZU TFI, one of Poland’s largest managers of DC pension savings, tells Jakub Janas and Carlo Svaluto Moreolo about the firm’s role in the Polish pension system

-

News

NewsUndersaving in British pensions still substantial, says government report

DWP is backing moves to widen eligibility for auto-enrolment

-

Country Report

Country ReportCountry Report – Ireland (February 2023)

Ireland is preparing an Auto Enrolment Bill, which will kick-start the process of defined contribution pension reform in earnest, some 15 years after the concept was first mooted. The plan is for a Central Processing Authority to administer the system and for up to four providers to tender for a chance to manage member contributions.

-

Country Report

Country ReportIreland: Final countdown to implementation for auto enrolment

Fifteen years after auto-enrolment was first mooted for Ireland, the automatic savings programme is nearly ready to be rolled out