All Covid-19 articles – Page 4

-

Special Report

Special ReportSpecial Report: European Pension Funds’ COVID Response

We also analyse how public development banks are going beyond their traditional remit, with a focus on post-COVID recovery, tackling climate change and meeting the UN Sustainable Development Goals.

-

Opinion Pieces

Opinion PiecesThe pandemic end-game

Overcoming COVID-19 and ensuring no recurrence is proving to be a formidable challenge for the global economy. The worst may still lie ahead. Even health systems in developed markets are creaking at the seams with the second and third waves of the pandemic. More transmissible mutations of the virus are making the task even harder.

-

Special Report

Special ReportOn the record: The path to recovery

Six major pension investors chart the risks and opportunities ahead as the world moves into a recovery phase

-

News

VBV sees AUM rise at slower pace year-on-year in 2020

Total assets rose by 6.3% in 2020 to a total €12.7bn, despite the pandemic

-

News

NewsAustrian Pensionskassen bounce back to positive returns in 2020

Austrian Pensionskassen increased the amount of sustainable investments to €20.5bn last year, up 25.8% compared to €16.3bn in 2019

-

News

Denmark’s €1.3bn crisis fund ready to invest; Möger Pedersen chairs

Former ATP chief Stendevad appointed as board member

-

News

Austrian investment funds see AUM peak all-time high in 2020

Net inflows saw an uptick after an outflow of €3.2bn in March at the peak of the first wave of the COVID-19 pandemic

-

Opinion Pieces

Opinion PiecesViewpoint: Blended finance and impact

Delivering the 2030 Agenda in the COVID-19 era and beyond

-

News

Dutch fiduciaries make switch to online manager selection

‘It’s really though to get the same information out of an online meeting as you would during on-site visits’

-

News

NewsSwiss BVK readjusts equity portfolio to profit from market fluctuations

BVK will adopt a new plan – Strategy 2021+ – from February to increase its allocation to equity, global real estate and infrastructure

-

News

NewsSwitch to video meetings puts Norway’s SWF off new managers

NBIM suggests low bond volatility undermines some of its rationale for including FI

-

News

Vaccine rally saves Dutch pension funds from having to cut pensions

The 90% minimum funding level will be valid until 2026, though a 95% level is needed for transition into the new DC-based system

-

Asset Class Reports

Asset Class ReportsInvestment Grade Credit: Always a demand for quality

Capital markets are fluctuating between optimism and pessimism

-

Features

FeaturesBriefing: Japan emerging from its invisible lockdown

Japan is all too often portrayed as being different from other countries. Not just distinctive in the obvious sense that every country has its own national peculiarities. Instead, somehow unique in a way that makes it stand out from every other country.

-

Opinion Pieces

Opinion PiecesUncertain conditions call for a steady course

The impact of COVID-19 has made long-term strategies that embrace resilience a high priority for pension funds to ensure there is a smoother ride during turbulent times.

-

Features

FeaturesFixed Income, Rates, Currencies: A very different recovery

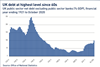

Amongst the remarkable happenings in 2020, from startling news of a pandemic to viable vaccine and beyond, has been the speed and scale of interventions from central banks and governments.

-

Opinion Pieces

Opinion PiecesJapan is not that different

One of the abiding myths about Japan is that it is different from everywhere else. Not just distinctive in the sense that all countries have peculiarities but uniquely different.

-

Features

FeaturesResearch: The shift from virtue to value

In the final article in a series of two, Pascal Blanqué and Amin Rajan argue that the success of ESG investing rests on a just transition to a low carbon future

-

News

Danish FSA dismayed by differences in how pension funds value alts

Watchdog says some unlisted asset types being revalued daily, but others quarterly

-

News

NewsStewardship roundup: APG co-files Amazon shareholder proposal

Plus: Investors keep up tailings dam standard momentum