All IPE articles in February 2019 (Magazine)

View all stories from this issue.

-

Features

FeaturesIPE Expectation Indicator: February 2019

The end of 2018 saw expectations shift meaningfully in certain markets, and then pause. It also saw trends accelerate, then pause. For most of us, the pauses were welcome, because the shifts were related to broad market plans

-

Opinion Pieces

Leading viewpoint: 2019's green investment picture

Lack of standards is not hindering green bond issuance. Pressure on corporates to finance the energy transition will intensify

-

Asset Class Reports

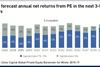

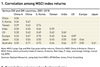

Asset Class ReportsAsset allocation: Opportunities abound despite volatility

The many uncertainties on the global stage might not be bad news for everyone

-

Opinion Pieces

Opinion PiecesBanking on life after politics

At 49, Brian Hayes is young man by political standards. Having started in Irish politics early with his appointment to the Irish Senate in the mid 1990s, Hayes was elected to the Dáil, the lower house, before he was 30, taking a seat for the Fine Gail party.

-

Features

FeaturesAhead of the curve: Hold faith in Chinese equities

Exposure to Chinese equities presents opportunities in both market beta and alpha

-

Special Report

Special ReportAlecta: a Swedish investor’s green bond learning curve

Alecta, the largest occupational pension provider in Sweden, with SEK874bn (€85.4bn) in assets, now invests SEK31.4bn in green bonds.

-

Opinion Pieces

Opinion PiecesIs BlackRock set to revive annuities?

What can happen if the largest global asset manager teams up with the largest software company, which also happen to be the first and second largest companies in the world by market cap?

-

Interviews

On the record: Asset management fees

We asked two European pension funds about their attitude to asset management fees and costs

-

Special Report

Special ReportAsset managers: New fee models

The growing passive investing trend is forcing investment managers to offer new fee structures

-

Special Report

Special ReportAsset managers: The profitability time bomb

How are asset managers responding to an environment with rising costs and fee pressures?

-

Interviews

InterviewsStrategically speaking: Sumitomo Mitsui Trust Asset Management

Following the group’s reorganisation, SMTAM’s David Semaya outlines ambitious plans to widen their international expansion

-

Features

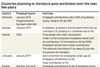

FeaturesAuto-enrolment grows globally

A growing number of countries are planning to reduce the strain placed on public finances of providing pensions to ever more retirees by encouraging individuals to make more adequate provision for their own retirement

-

Country Report

Country ReportIreland: Auto-enrolment strawman proposals

Auto-enrolment is one of the main goals of the Irish government’s pension reform plans

-

Special Report

Special ReportGreen finance: Financing environmental benefits

Green finance is drawing huge interest in light of climate change, but it needs to be about more than financial returns

-

Features

FeaturesBeyond green bonds

Green finance is booming. Interest in green finance is booming even more.

-

Special Report

Special ReportOcean finance: In search of blue returns

Attention on polluted seas is leading to discussions about how to marshal capital to clean them up

-

Special Report

Green bond funds: Mixed climate for European funds

Assets are up, but performance is down

-

Special Report

Special ReportWhy FRR doesn’t invest in green bonds – for now

While the French pension reserve fund has embraced and integrated the sustainability agenda in its investment strategies and was one of the first to incorporate climate change into its portfolio, it does not invest in green bonds