All IPE articles in February 2021 (Magazine)

View all stories from this issue.

-

Opinion Pieces

Opinion PiecesCOVID-19 barely tested the financial system

The financial system seems to have coped well with COVID-19. This is despite the repeated recent warnings about a build-up of systemic risk. In turn this has been linked to the abundance of cheap debt and the growth of the asset management industry.

-

Asset Class Reports

Asset Class ReportsHedge fund performance: 2020, year of the human touch

Diversification is back in favour for hedge funds and those with a downside protection mandate delivered during the crisis

-

Country Report

Country ReportCountry report – Pensions in Ireland (February 2021)

In 2018, the Irish government published its “Roadmap for Pensions Reform”, which set out plans for a national auto-enrolment system to be implemented for 2022. The implementation of changes has been dogged by delays, with COVID-19 joining the long list of obstacles slowing the country’s pension reform, as we analyse in this report. We also look at how volatile financial markets have impacted funding levels of defined benefit (DB) pension schemes, and explore the potential of the new regulated investment limited partnerships for institutional investors in private assets.

-

Features

FeaturesFixed Income, Rates, Currencies: Same again in 2021?

The relief from the farewells to 2020, and welcoming a Brexit trade deal, has waned in the face of rising COVID-19 infection rates. There have also been further lockdowns across swathes of Northern Europe as well as in Japan, Thailand, and South Africa to name a few. The vaccine-generated light at the end of the tunnel which appeared last year, seems rather distant, and possibly dimmer too.

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - February 2021

Interest has shifted from contamination and mortality data to vaccination figures. In this field, the US and UK are doing well, while the EU and Japan are lagging. Political risk is perceived to have gone. Donald Trump’s tendency to self-destruct is creating opportunities for the Republican Party to heal while Democrats are preparing an economic support package.

-

Opinion Pieces

Opinion PiecesLetter from Australia: Early access genie escapes the bottle

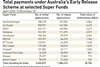

In March 2020, as the Australian economy went into COVID-19 lockdown the government unlocked the national superannuation pool, seeking to ease the financial stress on individuals.

-

Features

Accounting Matters: Auditing the auditors

There is widespread consensus that the audit sector is not fulfilling its potential, and that previous attempts at reform have been ineffective. As the impact of high quality audit goes far beyond the boardroom, when pension funds rely on audited financial statements for their capital allocation decisions, it is ultimately their individual members’ capital that is at risk.

-

Country Report

Country ReportHigh hopes for new ILP Act

The new types of funds should be the vehicle of choice for investment in private assets

-

Features

FeaturesBriefing: Active ways to prosper in EMs

On the battlefield on which active managers fought their passive enemies for investors’ custom, there was one patch of higher ground that seemed easier to defend – emerging market equities.

-

Opinion Pieces

Opinion PiecesInfra must adapt to meet pension goals

Looked at collectively, or even individually, the cashflow needs of Europe’s defined benefit (DB) and hybrid pension schemes are huge and potentially challenging given the scale of income generating assets needed to help service them.

-

Features

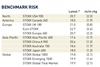

FeaturesAhead of the curve: Has the period of painless diversification ended?

With interest rates falling to historical lows the reality of a new financial landscape is confronting investors. It is one where the typical relationships between assets has come into question. In addition, basic ideas around diversification and portfolio construction no longer seem to match with the available investment opportunities.

-

Asset Class Reports

Asset Class ReportsValue equities: Dead or alive?

Today’s realities and intangibles have changed the face of value

-

Features

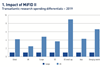

FeaturesBriefing: The sum of all fears

Three years on from the onset of MiFID II, market participants, governments and regulators are assessing its outcomes and considering adjustments.

-

Opinion Pieces

Opinion Pieces‘Close contact’ needed amid pandemic

Multiple lockdown restrictions have brought about a simpler way of working for some – remotely from home for most – but for institutional investors it also meant coming up with strategic models that could maintain the quality of asset managers’ due diligence – existing or potential.

-

Opinion Pieces

Opinion PiecesThe world is approaching an inflection point

Domestic challenges and US political developments have proved such a preoccupation recently that it has been all too easy to miss a key global shift. China’s rise to global prominence has accelerated markedly as a result of the past year’s events.

-

Country Report

Country ReportIAPF view: Positive aspects in a year of upheaval

There are signs that a significant movement towards pensions reform in Ireland could take place this year

-

Asset Class Reports

Asset Class ReportsHedge funds and distressed debt: Competition for assets will be fierce

Hedge funds will have to compete with private equity and credit funds for distressed opportunities following the pandemic

-

Features

FeaturesLong-term matters: Stop investing in autocracy

Europeans observing the US ‘near miss’ constitutional crisis have a choice – be spectators or show responsibility