Fixed Income – Page 28

-

News

BVK to keep diversification strategy amid COVID-19 turmoil

‘Planned real estate investments may experience delays’

-

News

Japan’s government fund increases foreign bonds by 10%

Fund pulls back on domestic government bonds exposure for the next five years

-

News

APG, PGGM buy NIB’s COVID-19 bond

Capital will be deployed to extend healthcare and increase companies’ capacity to produce medical equipment

-

News

BlackRock bond CIO sees buying opportunities

Selective potential in high yield where collateral and covenants are better

-

Features

FeaturesFixed Income & Credit: Potential for adventures

Emerging-market local-currency corporate debt is under-explored by global investors

-

Special Report

Special ReportStrategically Speaking: HSBC Global Asset Management

As the financial markets enter uncharted territory, HSBC GAM could be well placed to take advantage of the dislocations in Asian and emerging markets. Its aim, though, is to offer investors the full spectrum of fixed-income solutions, says Xavier Baraton, global CIO for fixed-income private debt and alternatives.

-

Interviews

InterviewsOn the record: Green bonds

IPE asked two Nordic pension funds how they invest in green bonds and to what extent sustainability is considered part of their fixed-income strategies

-

Features

FeaturesFixed Income & Credit: Loan covenant high tide?

Fitch Solutions outlines just how far covenant terms have steadily shifted in borrowers’ favour – at least until coronavirus hit

-

Features

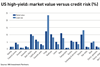

FeaturesFixed Income & Credit: High-yield worries grow

Global high yield and loans still offer attractive returns but the worry is about the stage we are in the credit cycle

-

Features

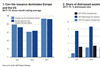

FeaturesFixed Income & Credit: Credit at a crossroads

How will weak lending standards hurt credit investors in a global slowdown?

-

Features

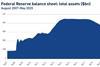

FeaturesFixed income, rates, currencies: Global economy under pressure

At the end of February, after a week that saw stock markets around the world plummet, US Federal Reserve chair Jerome Powell sought to calm fears, saying that the Fed would “act as appropriate” to support growth.

-

Opinion Pieces

Opinion PiecesViewpoint: Bond Yields Will Rise, But When?

U.S. bond yields have been declining for four decades; why would the next decade be any different? - Jim Caron, Morgan Stanley Investment Management, explains

-

News

NewsSwiss pension fund tenders $2.4bn in fixed income

Derivatives are only allowed to steer duration and must be covered by highly liquid assets

-

Analysis

AnalysisFixed income, rates, currencies: China’s woe hits rest of world

While the speed and breadth of the spread of infection was unknown, it was apparent that the outbreak of the new coronavirus, named COVID-19 by the World Health Organization (WHO), would cause considerable disruption to economic activity in China.

-

News

NewsWestminster scheme weighs renewable infra move

Adviser recommends at least 5% allocation to illiquid alternatives and extra 5% in fixed income

-

News

NewsNBIM backs shorter LSE trading hours, cites better pricing

Accessing natural liquidity has become harder for institutional investors, says oil fund

-

News

Alecta ramps up DB contributions by 16%, blaming longevity and yields

Swedish pension fund sees more life expectancy increases ahead

-

Features

FeaturesFixed income, rates, currencies: A confident start to the year

Undoubtedly a good year for financial assets, 2019 ended on a bright note with the broad, and relieved, consensus that the China/US trade conflict might be de-escalating

-

News

Active management drives Industriens Pension’s 12% 2019 return

Listed equities, government and mortgage bonds beat benchmark for Danish pension fund

-

News

Japan’s GPIF focuses on social bonds

GPIF joins forces with Islamic Development Bank to target green and sustainable sukuk