Fixed Income – Page 30

-

News

NewsNEST names managers for first move into private markets

Amundi and BlackRock will manage roughly 5% of the DC master trust’s default funds with inflows expected to start in October

-

News

Fresh QE likely to boost corporate bonds, say managers

Mario Draghi’s final appearance as ECB president bought a 10-basis-point rate cut and open-ended quantitative easing

-

News

NewsPensionDanmark cuts bonds, adds to real assets in face of low yields

Interim report reveals PensionDanmark’s highest ever first-half return, but CEO Torben Möger Pedersen warns of low and negative yields

-

News

NewsCould holding negative-yielding bonds clash with fiduciary duty?

Cambridge Associates says trustees and pension fund managers should review LDI mandates and passive government bond allocations

-

Features

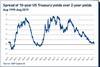

Fixed income, rates, currencies: A bleak outcome

This year’s summer tensions in shallow markets have again been apparent. The fallout from the trade dispute between China and the US is having a global impact. Together with economic weakness almost everywhere, a global policy easing cycle could be imminent.

-

News

Chart of the Week: The UK’s biggest asset managers

LGIM, Insight and BlackRock are increasing their dominance over the UK institutional pensions market, according to IPE research

-

News

NewsATP’s bonus potential swells after €1.9bn bond gains in Q2

Danish pensions giant reins in relative risk in its €45bn investment portfolio, eyeing a possible recession on the horizon

-

News

Chart of the Week: Italy’s coalition collapses – bond markets barely blink

Italian prime minister Giuseppe Conte quit his post this week, signalling the end of the controversial coalition government of the Five Star Movement and the Northern League

-

News

Norway’s SWF holds €60bn of negative-yielding bonds

Fixed income netted the NOK9.4trn fund 3.1% in the second quarter of 2019, but a quarter of its allocation now yields less than 0%

-

News

NewsIncluding ESG in fixed income ‘boosts market efficiency’, says Norway’s GPFN

Folketrygdfondet chiefs argue that responsible management of fixed income portfolios gives more holistic view of companies

-

News

NewsESG overlay ‘boosts outcomes for corporate bond investors’: report

Benefits of incorporating ESG factors include lower drawdowns and reduced portfolio volatility, according to JP Morgan Asset Management

-

News

Italian roundup: Fonchim offers five mandates worth €1.75bn

Utilities sector fund Pegaso seeks consultant; Media industry fund tenders mandates for equity and bond managers

-

News

NewsESMA advises against explicit ESG analysis mandate for credit rating agencies

Watchdog says credit rating agencies should stay focused on creditworthiness, but transparency of how they consider ESG factors could be improved to help investors

-

News

GAM completes wind-up of suspended absolute return bond funds

Investors due to receive equivalent to an “average” of 100.5% of portfolio value after a 10-month process to liquidate the CHF7.3bn fund range

-

News

Chart of the Week: Which country’s pension funds invest the most domestically?

Mercer’s European Asset Allocation report reveals the countries whose pension funds have the largest allocations to domestic equity, corporate bonds, and government bonds

-

Features

FeaturesFixed income, rates, currencies: Nervousness abounds

The weak US non-farm payroll (NFP) data for May, far below forecasts, sent rates falling and stocks rising, on the supposition that it raised the likelihood of interest rate cuts from the Federal Reserve. On the other hand, while risk markets cheered the prospect of easier money, the hardline approach taken by the US towards China, and China’s uncompromising responses are raising investor nervousness.

-

Special Report

Special ReportInvestment services: Accessing China's bond market

Access to China’s fixed-income market is cheaper and easier than ever

-

News

AXA IM calls for ‘transition bonds’ to help companies go green

New type of debt could help investors overcome challenge of financing companies aiming to become more environmentally-friendly

-

News

Italy roundup: Allianz GI wins €220m mandate from Fondo Telemaco

Tenders announced by a number of other pension funds including Fondo Pensione Nazionale BCC/CRA, Fondo Crédit Agricole, and Fondo Cometa

-

Features

FeaturesIPE Quest Expectations Indicator: June 2019

Last months’ move away from political risk continued this month for the US, the EU and Japan. The UK figures were stable or moving slightly in the opposite direction, reflecting worries over Brexit with the UK body politic in disarray.