All articles by Florence Chong – Page 4

-

Opinion Pieces

Opinion PiecesLetter from Australia: A question of gender imbalance

Statistics offer a snapshot into the real world and they reveal a depressing picture of gender inequality in Australia’s superannuation system.

-

Opinion Pieces

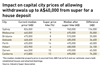

Opinion PiecesLetter from Australia: Should super savings fund homes?

A post-COVID-19 housing boom has made the future of Australia’s A$3trn (€2trn) superannuation savings pool a hot topic.

-

Opinion Pieces

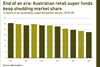

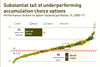

Opinion PiecesLetter from Australia: Retail super funds in distress

Australia’s once-dominant retail super funds are witnessing the end of an era as they wrestle with loss of consumer confidence in their brands. Hastening change has been the rise of industry supers, which benefitted from damaging evidence provided to the Hayne Royal Commission in 2018.

-

Opinion Pieces

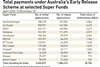

Opinion PiecesLetter from Australia: Early access genie escapes the bottle

In March 2020, as the Australian economy went into COVID-19 lockdown the government unlocked the national superannuation pool, seeking to ease the financial stress on individuals.

-

Special Report

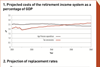

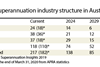

Special ReportDefined contribution: Australia's super review re-opens old battlegrounds

The Callaghan report on Australia’s universal superannuation system has rekindled a row between the government and the labour movement

-

Opinion Pieces

Opinion PiecesLetter from Australia: Reforms not super for default funds

A string of government reforms due to come into effect from July 2021 has caught the superannuation sector off-guard.

-

News

GPIF: Climate risk impacts all asset classes

If the world could limit global warming from greenhouse gas emissions to 2°C, the value, particularly of Japanese companies, would increase

-

Opinion Pieces

Opinion PiecesLetter from Australia: Funding the future world

A handful of Australian superannuation funds are committing their members’ savings to the future world in terms of energy, water, technology and ideas. There will be successes and failures as ideas are developed and marketed.

-

Opinion Pieces

Opinion PiecesLetter from Australia: ESG stirs some ancient ghosts

In May this year, Rio Tinto blew up one of Western Australia’s most significant Aboriginal heritage sites.

-

Opinion Pieces

Opinion PiecesLetter from Australia: Pooling for savings and strength

The government, the regulator and economic fallout from COVID-19 have combined to pressure Australia’s large and unwieldy pool of super funds towards consolidation.

-

Special Report

Special ReportChina: ESG with Chinese characteristics

Pressure from international and domestic investors is driving an upsurge in ESG adoption by Chinese companies

-

Opinion Pieces

Opinion PiecesLetter from Australia: Paltry pickings in the political pie

As deficits mount in a post-COVID-19 world, politicians and bureaucrats are again eyeing national pension savings – hundreds of billions of dollars they can capture at the stroke of a legislative pen.

-

News

Super industry sees liquidity challenge as members switch to cash

COVID-19 has put a spotlight on liquidity

-

News

Singapore’s GIC creates private asset investing framework with PGIM

‘Liquidity risk one of the most critical, but least quantified risk dimensions in portfolio construction’

-

News

Australia’s Future Fund makes a A$5.7bn Q1 loss

The fund prioritised reducing its exposure to illiquid assets

-

News

Japanese government fund preps move into bonds, EM infra

Considering a fund-of-funds manager as part of its global infrastructure strategy

-

News

Australians request super savings early release

AustralianSuper expects to receive requests from more than 300,000 members

-

News

GPIF picks Goldman Sachs executive as CIO

The new hire comes at a time when the world’s largest pension fund is pivoting towards international investment

-

News

Japan’s government fund increases foreign bonds by 10%

Fund pulls back on domestic government bonds exposure for the next five years

-

News

Australian supers face A$25bn payout to jobless members

Retail and hospitality, tourism and recreation are hardest-hit sectors