Government Bonds – Page 2

-

Features

FeaturesFixed income, rates, currencies: Questions over US economic policy dominate global concerns

As ever, the US dominates the global economic landscape. While there is still considerable uncertainty around possible tariffs emanating from the US – despite deals struck by the UK, China and Vietnam – the levels are still expected to be markedly lower than those trumpeted on 2 April.

-

News

NewsFrance’s FRR appoints duo for €1.4bn fixed income mandates

AXA Investment Managers and Ostrum Asset Management were selected

-

News

NewsDutch funds see funding ratios rise in Q1 despite negative returns

Dutch pension funds felt the effects of Donald Trump’s trade war in the first three months of the year as interest rates rose and assets fell

-

Features

FeaturesIPE Quest Expectations Indicator - May 2025: US markets lose their wings

Markets have been gyrating wildly with Trump’s on-again-off-again trade wars, but resistance is building

-

Features

FeaturesIPE Quest Expectations Indicator - June 2025

At last, we have some clarity about the nature of ‘Trump risk’ – it is about uncertainty and growth. Markets are signalling that the US president’s on-again-off-again policies are a threat to growth and stoking inflation even if his threats are not implemented.

-

Features

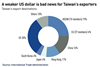

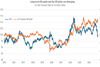

FeaturesChart watch: Uncertainty ripples across markets

The trade war unleashed by Trump’s tariffs and the knock-on effects for business confidence and commodities demand are reflected in our latest chart overview

-

Features

Fixed income, rates, currencies: Fickle US policy shakes global investor confidence

The hugely unpredictable policy announcements from those in charge of the world’s largest developed economy are market events more usually associated with goings-on in a newer EM economy

-

Features

FeaturesIPE Quest Expectations Indicator - April 2025

Since 1900, the US has waged numerous wars but has won only three without allies. This is the sobering background for recent US geopolitical policy moves: changing sides from Ukraine to Russia, interfering in German elections and behaviour at the NATO ministerial meeting.

-

Features

FeaturesIPE Quest Expectations Indicator - March 2025

Political risk has risen to boiling point. Donald Trump’s talks with Russia to end the war in Ukraine, without as much as a Ukrainian presence, left the US without allies or credibility, especially in Europe.

-

Features

FeaturesFixed income, rates, currencies: Trump’s tariff announcements weigh on sentiment

As tariff announcements garner huge amounts of media attention, financial market reactions have been muted. Participants are trying to beat off tariff fatigue and assess the best path through all the smoke and mirrors.

-

Features

FeaturesCentral banks and cryptocurrency reserve: set for a breakthrough?

After courting the crypto community during his presidential campaign, Donald Trump issued an executive order in early March to create a US strategic bitcoin reserve, as well as a national digital assets stockpile of tokens other than bitcoin.

-

Features

FeaturesFixed income, rates, currencies: Markets rocked by Trump’s sweeping tariffs plan

The world’s economy enters a new phase as the US administration escalates towards a global trade war, raising the prospect of a US recession and crashing global financial markets

-

News

NewsDanish pensions lobby proposes government issue defence bonds

IPD says issuing defence bonds could also send a signal on ‘legitimacy’ of arms as investment assets

-

News

NewsState Street loses £28bn of The People’s Pension’s assets to Amundi and Invesco

State Street has previously managed all of the master trust’s assets worth £32bn

-

News

NewsDNB scheme ups risk in new Dutch pension system

The pension fund of the central bank will drastically cut its government bond exposure and increase its risk profile

-

News

NewsDenmark’s LD bumps up risk exposure as holiday fund returns 11%

Pensions manager broadens investment universe with listed alternatives, and adds emerging market government bonds

-

Features

FeaturesFixed income, rates, currencies: Uncertainty reigns as Trump 2.0 takes office

Now that Donald Trump has been installed as US president, there should be more clarity around some of the timings of his probable new policies.

-

Features

FeaturesIPE Quest Expectations Indicator - February 2025

The erosion in trust in the US is promoted by its refusal to participate in a proposed trigger force in Ukraine. In response, European defence expenses are rising, in particular in Poland, the Baltics and Scandinavia.

-

News

NewsBoE launches repo facility to help tackle severe Gilt market dysfunction

The CNRF will lend to participating insurance companies, pension schemes and LDI funds to help maintain financial stability

-

Features

FeaturesFixed income, rates, currencies: Trump 2.0 sends global markets out of sync

Trump’s re-election prompted a rally in US assets, but elsewhere in global markets investors did not react positively