Government Bonds – Page 6

-

Special Report

Special ReportOutlook – Europe and the world: CIOs focus on bonds and quality stocks

With the prospect of weaker growth, volatility and higher inflation and rates, strategists argue for more selectivity in investments

-

Features

FeaturesFixed income, rates & currency: Strong labour markets surprise

Global purchasing managers’ index (PMI) data, which measures the state of the US economy, has been mostly strong, although manufacturing indices have been considerably weaker than services, perhaps reflecting their greater sensitivity to higher interest rates.

-

News

NewsItaly roundup: Previndai ups exposure to corporate, government bonds

Plus: Eurofer pushes on with direct investments

-

News

NewsIceland’s pension funds fear €1bn losses under housing bond plan

Pension fund group says on firm legal ground, and warns the government of years in court

-

Features

FeaturesIPE Quest Expectations Indicator May 2023

Russian air superiority over Ukraine is coming to an end due to lack of equipment. Destroying civilian targets is counterproductive and consumes ammunition. Bakhmut is eating into Russian resources, while Ukraine is being re-armed. History teaches that better technology, rather than numerical superiority, wins wars. But even a lopsided Ukrainian win would not automatically mean peace.

-

Asset Class Reports

Asset Class ReportsFixed income – New beginning for bond investors

A painful 2022 for fixed income means attractive opportunities and a possible normalisation in risk and return

-

Asset Class Reports

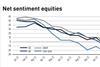

Asset Class ReportsPortfolio strategy – Fixed income

Last year ushered in a new era for global fixed income and credit markets. It was the worst, in terms of returns, for bond investors in years, but it signalled a regime change. Investors need to be prepared for structurally higher inflation and rates, as well as higher volatility. But for fixed income managers, this is an environment where value is easier to find. Our report looks at this new beginning for fixed income investors, and at how selectivity has become key in the high yield and loan markets.

-

Features

FeaturesAhead of the curve: Introducing the concept of a carbon risk-free curve

As global investors and companies progress towards their net-zero emissions targets, the concept of a carbon risk-free curve becomes increasingly relevant within the fixed-income market. In our view, this curve should provide a reference for evaluating the risk levels of bonds in relation to their issuers’ CO₂-equivalent (CO₂e) emissions and can therefore help investors to assess the impact of changes in CO₂e emissions on the yield spread of fixed-income bonds.

-

Opinion Pieces

Opinion PiecesAustralia: Super funds shift to fixed income

With fear of recession in Australia and globally, superannuation funds have gone into defensive mode. Cash and liquidity are two key considerations for CIOs, and some are waiting to take advantage of attractive market opportunities.

-

Features

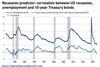

FeaturesFixed income, rates & currency: Optimism fades on mixed data

January’s market optimism has been subsiding, as forecasts for inflation and US Federal Reserve policy shift the outlook further to the hawkish side. However, the macro picture is not clear. Markets hang on to every new piece of data to clarify the outlook, be it non-farm payrolls, the consumer price index (CPI) or the US Job Openings and Labor Turnover Survey (JOLTS).

-

Features

FeaturesIPE Quest Expectations Indicator March 2023

The next Ukrainian offensive will be in April at the earliest, as modern tanks will have arrived by then. US Republican pushback of ESG and climate-related investments are a new bone of contention in relations with the EU, already strained by the Trump presidency, and a bad sign for US-EU co-operation on China policy, an issue Japan seems to be ducking successfully. Aided by a soft winter, EU energy concerns have become quite manageable.

-

Country Report

Country ReportGermany: Financing the Energiewende

German professional pension funds like ÄVWL and BVK are keen to support the energy transition process

-

Features

FeaturesFrom soft landing to no landing

Once again, the US jobs market has shown its capacity to surprise forecasters, if not astonish them. January’s non-farm payroll numbers came in way above consensus forecasts, swiftly reversing markets’ dovish take on that week’s central bank actions, with bond markets handing back much of their earlier gains.

-

News

NewsGermany roundup: Institutional investors return to German government bonds

Plus: Pension schemes up investments in Spezialfonds

-

News

NewsNZAOA, BTPS, Church of England back climate performance tool

‘There is no rating or ranking or investment advice, just free, comparable data points for investors to use as they wish,’ says Barron

-

Features

FeaturesAhead of the curve: Time to automate collateral management

The resilience of financial markets has been tested several times in recent years, from the so-called ‘dash for cash’ at the start of the coronavirus pandemic in March 2020 to the spike in UK Gilt yields in September 2022.

-

News

NewsSkandia invests SEK500m in first bond linked to new SWESTR rate

As long-term investor, Swedish pensions firm ‘appreciates transparency’ of new transaction-based reference rate

-

Opinion Pieces

Opinion PiecesViewpoint: Gilts crisis won’t undermine attractions of private markets for long-term investors

Many of the government’s ambitions to reboot growth in the UK economy require solutions which private assets are well equipped and prepared to provide in a timely manner

-

Features

FeaturesIPE Quest Expectations Indicator: December 2022

The Ukrainian offensives look to have petered out and a new initiative will be needed to maintain morale. The US government is once again gridlocked and another debt ceiling fight is likely. The EU seems ready even for a harsh winter, but there are signs of war fatigue. In the UK, Prime Minister Rishi Sunak has apparently learned from the Liz Truss debacle, quickly making the necessary political U-turns, in particular on climate change. Expectations for the COP27 meeting in Sharm El-Sheikh were low. Analyst views indicate increasing belief that the wave of interest rate increases is receding.

-

Special Report

Special ReportProspects 2023: Does zero China make sense?

Many investors are avoiding the People’s Republic, but they would do well to look at the reality