Government Bonds – Page 9

-

News

Dutch pension funds undisturbed by rising inflation

Some pension funds have shown increased interest in inflation-linked bonds to hedge against inflation risk

-

News

AkademikerPension blacklists nine regimes including Belarus and Iran

Danish pension fund sells off €83m of holdings in foreign government bonds and state-owned companies

-

News

Sampension: November rally lifted YTD returns into solid plus zone

News of COVID-19 vaccine successes propelled Danish firm’s market-rate pension return to 4.17% year-to-date

-

News

European investor tenders €400m logistics mandate

Swiss-based consultant seeks manager for government bonds contract

-

News

NewsCEPB’s Matthews calls for ‘Climate Action 100+ for sovereigns’

Reveals Transition Pathway Initiative will next year produce sovereign bond assessments

-

Special Report

Special Report2021 Investment Horizons: Hazy outlook for hedging

Investors must be cautious when navigating today’s cloudy inflation landscape

-

News

NewsSweden’s Kåpan ups green bond weighting, expands fossils strategy

Swedish government employees’ pension fund says it bolstered sustainability in asset classes as well as overall operations this year

-

News

Italy roundup: Inarcassa rejigs government bonds allocation

Plus: Pension fund returns improve, Fopen seeks fund depositary, Fondoposte elects president, VP, Previp chooses Anima Sgr over BNP Paribas

-

News

Danish scheme blacklists state-linked China, dumping €54m equities, bonds

AkademikerPension says aims to raise its social responsibility profile

-

News

Germany green bond-linked spending spans real, intangible assets

Federal government has unveiled the framework for its upcoming inaugural green bond issuance

-

Opinion Pieces

Opinion PiecesViewpoint: Managing euro zone sovereign risk in the face of the pandemic

Considerations for pension plans and other institutional investors

-

News

BTPS keen for big voice in ESG/fixed income debate, says CEO

Credit rating agencies should step up their game on ESG, Nilsson says

-

Features

FeaturesAhead of the curve: Liquidity has been the litmus test for China’s bond market

It is no safe haven, but China has provided bond investors with important shelter through the storm

-

Asset Class Reports

Asset Class ReportsCredit: Interest grows in Chinese bonds

Foreign investors are finding Chinese government bonds increasingly attractive

-

Features

FeaturesWhen safe haven assets aren’t safe

In the current environment, investors look set to lose money on European government bonds – a quintessential safe-haven asset

-

Features

FeaturesFixed income, rates, currencies: Better than expected

Although packed with geopolitical surprises 2019 turned out to be better than expected for financial assets. Equities and bonds rallied together reversing last year’s ‘unusual occurrence’ of both performing badly.

-

Asset Class Reports

Asset Class ReportsUS investment grade: A year for not living dangerously

Geopolitical uncertainties are pushing investors away from longer-term strategies

-

Asset Class Reports

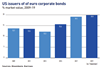

Asset Class ReportsFixed Income – European investment grade: No sign of end for negative yields

Negative interest rates look set for a lengthy run in Europe, raising concerns about the long-term effects

-

News

Pension funds hail new Danish 30-year bond as yield-curve definer

Danish government returns to long issuance after 10-year absence

-

News

Pension fund seeks info for €950m EM govvie mandate via IPE Quest

Responses will inform the investor’s longlist selection