In Depth – Page 25

-

Features

FeaturesWhen safe haven assets aren’t safe

In the current environment, investors look set to lose money on European government bonds – a quintessential safe-haven asset

-

Features

FeaturesFixed income, rates, currencies: Better than expected

Although packed with geopolitical surprises 2019 turned out to be better than expected for financial assets. Equities and bonds rallied together reversing last year’s ‘unusual occurrence’ of both performing badly.

-

Features

FeaturesAhead of the Curve: Measuring the right thing

The old adage, ‘measure twice, cut once,’ only works if you measure the right thing. The prominence of GDP growth as the ultimate gauge of economic performance, for example, is increasingly a case of measuring the wrong thing. A single metric cannot hope to capture all the complex trends that develop below the surface of a modern knowledge and services-based economy.

-

-

-

Features

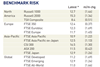

FeaturesIPE Quest Expectations Indicator: January 2020

Bond sentiment remains stable, but still negative. US net bond sentiment is edging towards zero, which is surprising as the Fed is set on neutral.

-

Features

Emerging market debt: Argentina makes investors cry

Who needs Pennywise the terrifying clown when one has Argentine bonds in their investment portfolios?

-

Features

Ongoing UCITS fees are falling

UCITS are an example of EU financial innovation and a global success story. With €10.1trn in total net assets, UCITS help global investors save for financial goals, including retirement, education, and housing.

-

Interviews

Strategically speaking: Scientific Beta

I am probably a little bit uncompromising,’’ says Noël Amenc, the founding CEO of Scientific Beta, the provider of factor indices and strategies. To those who know him that is an understatement.

-

Features

FeaturesBriefing: Peer-to-peer securities lending

The words scale, operational efficiency and lower cost feature regularly in the State Street discussion of its new peer-to-peer securities lending product. Direct Access Lending enables direct, principal loans between its lending clients and its borrowing clients.

-

Features

FeaturesAhead of the Curve: Value investing in the next decade

Winds of change are blowing relentlessly across the globe and the investment world is no exception. Central to this evolution is the growth of intangible assets, ranging from brands and patents to franchise agreements and digital platforms.

-

Features

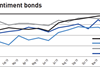

FeaturesIPE Quest Expectations Indicator: December 2019

With the shift to a strong negative bond sentiment in the UK, markets have again split. For the UK and EU, the figures are more negative and trending down.

-

Features

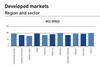

FeaturesBriefing: There is still room for growth

Equity investors putting faith in growth stocks – stocks that are priced expensively relative to fundamentals because they are expected to grow fast – received a shock in early September when they sold off sharply.

-

Features

FeaturesBriefing: Alternatives to large-cap buyouts

Large buyout funds are a staple ingredient in many institutional pension funds’ private-equity portfolios. Focusing on more diversified private-market strategies could be a better way to achieve return objectives

-

Features

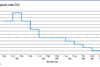

FeaturesAhead of the curve: The duration bubble

Has the world entered a new paradigm in which growth, inflation and value investing are dead? Various indicators might have us believe this is the case.

-

-

Interviews

InterviewsStrategically speaking: Generali Investments

A year into Generali’s ambitious growth plan, it looks set to meet its promises

-

Features

FeaturesIPE Quest Expectations Indicator: November 2019

Bond sentiment has been trending upwards for a year, approaching a net value of zero everywhere, except in the EU. Analysts contend that central banks have secured a soft landing.

-

Features

FeaturesBriefing: Draghi’s parting gift on ECB stance

If anyone in Europe was left in any doubt on 11 September about the dovishness of the European Central Bank (ECB) under Mario Draghi’s leadership, by close of business on the next day their doubts were surely dispelled. On that day the outgoing president of the ECB unleashed a bout of monetary easing, in an attempt to boost euro-zone inflation from 1% to its target of “below, but close to, 2% over the medium term”.