In Depth – Page 26

-

Features

FeaturesBriefing: Coping with lower for much longer

German institutional investors have shifted their asset allocation due to low bond yields

-

Features

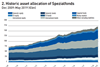

FeaturesGerman Spezialfonds show modest asset growth

Germany’s Spezialfonds market showed modest positive growth in 2018 in the face of challenging market conditions, with total assets approaching €1.5trn.

-

Interviews

InterviewsStrategically speaking: Wells Fargo Asset Management

By his own account Nico Marais is an extraordinarily lucky man. The CEO of Wells Fargo Asset Management (WFAM) is keen to use every opportunity to emphasise his good fortune. In Marais’s modest telling of his own story, his success is thanks to the qualities of others, rather than to his own merits. “It’s the story of my life. I’ve just always worked for amazing people,” he says.

-

Features

FeaturesAhead of the curve: New economy, same old returns?

“You can see the computer age everywhere but in the productivity statistics.”

-

-

Features

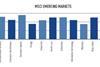

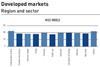

IPE Quest Expectations Indicator: October 2019

There has been a widening of the equity sentiment gap between the euro-zone and the US, and the UK and Japan.

-

Features

Briefing: The cliff-hanger of European banks

It has been a bad decade for European financials, with share prices still a fraction of their pre-crisis highs

-

Features

Briefing: Give credit to CDS indices

DB pension funds could benefit from synthetic credit exposures provided by credit default swap indices

-

Features

Briefing: Sri Lanka after the bombings

The tragic Easter Sunday bombings have devastated tourism, a key plank of the economy

-

Interviews

Strategically speaking: APG

If people ask Peter Branner why he moved from Sweden to the Netherlands to run the asset management arm of APG he might tell them that he is in effect chief investment officer for more than a quarter of the Dutch population

-

Features

Ahead of the curve: The psychology of contrarianism

Sociologists are likely to see contrarian investors as deviants, while psychologists may see them as healthy, ‘independent’ thinkers

-

-

Features

IPE Quest Expectations Indicator: September 2019

Market sentiment has split in two. For the euro-zone and the US, there was a correction that did not affect trends and equities are still favoured. In the UK and Japan, sentiment is moving towards favouring bonds

-

Features

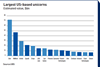

FeaturesIPOs: Unicorn hunting

“Public interest in IPOs hasn’t been this high since the dot-com era of the late 1990s,” say analysts at UBS. Such popularity is stoking fears of a bubble in unicorns – privately-financed start-ups valued at over $1bn (€900m) taking listings.

-

Features

FeaturesLiquidity: Bad timing

Pension funds lose billions annually in badly timed trades in the capital markets

-

-

Interviews

InterviewsStrategically speaking: Muzinich & Co

We are living in Disneyworld,” says George Muzinich, the CEO and chairman of Muzinich & Co, a New York-based investment manager specialising in corporate credit.

-

Features

FeaturesAhead of the curve: The bubbles to come

Market bubbles would not happen in a perfect world. But humans are not perfect and our economies are inherently unstable.

-

-

Features

FeaturesIPE Quest Expectations Indicator: July 2019

Markets are still driven by political risk and growth prospects. It looks like the two risks are working in the same direction this month.