IPE's EU Coverage – Page 12

-

Special Report

Special ReportWhat should EU investors do if the Republicans win the White House?

Sustainability-minded investors should wake up to the challenge of right-wing populism and its threat to climate policy

-

News

NewsSwedes see refund from dropped Russian, East European premium pension funds

Pensions agency announces further SEK247m refund from Barings, East Capital and Nordea funds – deregistered after Ukraine invasion – to first-pillar pension savers

-

News

NewsIreland’s new €100bn SWF is no ‘rainy-day fund’, says McGrath

Budget plans include two sovereign wealth funds, with largest designed to cover known future costs

-

News

NewsESMA study fails to find a systematic greenium for sustainable bonds

EU supervisory body researchers say willingness to accept lower returns for ESG is limited

-

Features

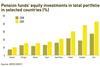

FeaturesResearch: Pension funds stabilise EU financial markets in good times and bad

A recent study investigated the potential stabilising role of pension funds in financial markets in the European Union from 2001 to 2017

-

Special Report

Special ReportActive ETFs power ahead

While active managers are out of favour, their strategies embedded in an exchange traded fund package are gaining traction. In fact, they are outpacing passive ETFs as investors look for liquidity and robust risk-adjusted returns with a relatively low price tag.

-

News

NewsAkademikerPension sees positive return impact after shedding last oil/gas major

Danish occupational pension fund divests Italy’s Eni, excluding last large upstream oil and gas company in its portfolio

-

News

NewsAP2 helps German think tank develop portfolio tool to assess deforestation risk

In work funded by Californian philanthropists, Swedish national pensions buffer fund says publicly-accessible workflow will be tested on AP2’s listed equities

-

Opinion Pieces

Opinion PiecesEurope escaped the Great Retirement Boom but watch out for the crunch

Continental Europe appears to have largely escaped the trend known in the US as the ‘Great Retirement Boom’, where an economically comfortable cohort of 50 to 64-year-olds has retreated from work in the post-COVID period.

-

Asset Class Reports

Asset Class ReportsRethinking net-zero equities benchmarks

The EU developed rules for climate benchmarks in 2019. After a surge in uptake, investor sentiment is already cooling

-

News

NewsIlmarinen posts 3.7% H1 return; CEO urges solvency framework reshape

Listed equities form backbone of investment gain while property returns hover around zero

-

Features

FeaturesDiscerning investor sentiment: this year’s proxy season

Every annual general meeting (AGM) season has traditionally brought with it a few symbolic moments – events that serve as broader indicators of the market’s mood when it comes to environmental and social issues.

-

News

NewsEIOPA says national supervisors need more data on liquidity risks

European pension funds, insurers holding up well despite higher stability risks, says latest risk report from EU pension and insurance watchdog

-

News

NewsIlmarinen anchors new Amundi climate-focused Europe ETF with €580m

Finnish pensions major edges closer to having all its passive equities tracking MSCI’s Climate Action indices

-

Special Report

Special ReportSpecial Report – Outlook: Europe and the world

Inflation may be losing momentum, thanks to vigorous central bank action, but with a recession on the horizon, it is hard to tell whether the next few months and years will see markets turn around and risk assets begin to perform again. For the time being, CIOs argue for selectivity in stock selection and generally agree that bonds have resumed their diversification role. The main article in our Outlook report features the views of influential CIOs and strategists on asset allocation for the next few years.

-

Special Report

Special ReportOutlook – Europe and the world: US overtakes Europe in clean-energy production

Incentives package for US-based clean energy investments is seen by some as a threat to Europe’s industrial competitiveness

-

Special Report

Special ReportOutlook – Europe and the world: UK launches its own approach to green investment

The focus is on financial regulation rather than economic policy to drive decarbonisation

-

Special Report

Special ReportOutlook – Europe and the world: Ageing Europe puts strain on growth

The continent is the oldest in the world, with fast shrinking populations and lower fertility rates

-

Interviews

InterviewsLCH: The other side of the mirror

Isabelle Girolami undoubtedly has a strong background in financial services, having worked for a range of very different institutions in very different roles. She was COO at the fixed income division of BNP Paribas, before going on to a similar role at Bear Stearns, the bank that failed early in 2008 and which was subsumed into JP Morgan. Prior to her current role at LCH she was global head of markets at Crédit Agricole.

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Pensions and the EU's plans on social protection

Elections for the European Parliament will be held in spring 2024, after which a new European Commission will be formed. Early preparation to collect new ideas is ongoing. The Commission’s high-level group on the future of social protection and of the welfare state published a report in February, taking a wide-angle look at social protection, including pensions.