IPE's United Kingdom Coverage – Page 58

-

News

NewsUnited Utilities pension funds secure £1.8bn buy-in deal with Legal & General

L&G provided a bespoke price lock to the assets held by the schemes

-

News

NewsSchemes should stay on top of changing mortality rates

Current mortality rates ‘highlight the problems of matching investment strategies to liability cash flows’, says Mercer

-

News

NewsSEI acquires National Pensions Trust for £42.5m

The total combined assets of NPT and SEI Master Trust will be approximately £3.4bn

-

News

NewsProposals to boost investment in UK growth should not be rushed

It is important that the government seeks a range of views through an extended consultation process, says XPS

-

News

NewsRolls-Royce pension fund picks BlackRock for custom-built default fund

Plus: LPP invests in Federated Hermes’ private equity fund; GAD completes methodology assessment into British Steel scheme; Osmosis partners with SuMi TRUST

-

News

NewsLGPS funds should retain autonomy over asset allocation, says pensions industry

External directives ‘may backfire’ and lead to ‘poorer outcomes’ for scheme members and sponsoring employees, says Hymans Robertson

-

News

NewsNBIM asks for change to European green reporting standards on materiality

As European Commission’s consultation on draft European Sustainability Reporting Standards closes, Norway’s SWF manager says companies should be made to say why topics are not material

-

News

NewsWave of demand for bulk annuity market expected to hit record level

Bulk annuity market doubled over the last five years, says PIC

-

News

NewsChancellor reveals plans to boost pension investments in UK growth

Plus: DC pension schemes sign up to Mansion House Compact

-

News

NewsDWP and Treasury consult on trustee skills, capability and culture

’The main concern seems to be the ability of trustees to make investment decisions but the review may also have wider benefits,’ says Hymans Robertson

-

News

NewsUK roundup: Small DC schemes fail to meet value expectations

Plus: Border to Coast sets up engagement programme; Risk sharing could provide an age-old solution, says Hymans Robertson; Impact Cubed launches SDG dataset

-

News

NewsLothian scheme commits to infrastructure with 13.4% allocation

The value of unquoted private equity, infrastructure, timber and secured loan investments at 31 March 2023 stood at £1.7bn

-

News

NewsChurch of England exits Net-Zero Asset Owner Alliance

‘Given the size of the organisation, a clear focus on one initiative was needed,’ says CEPB’s director of climate and environment

-

News

NewsUK roundup: Chubb pension schemes complete £1bn buy-in deal

Plus: Cushon partners with Link Group to deliver customer experience outcomes; Big Society Capital picks XPS as investment adviser

-

News

NewsClimate scenario analysis ‘makes fiduciary duty arguments harder’ for net zero investors

IFoA paper says the underwhelming results of climate analysis come from the narrowness of the scenarios being tested

-

News

NewsPPF expands sustainability drive with new strategy

Plus: Church Commissioners’ sustainability report shows farmland to be highest carbon emitter

-

News

NewsABP sold €170m Thames Water stake in 2022

The sale came shortly after the Dutch civil service scheme had engaged with the troubled water firm on ‘several issues’ in 2021

-

News

NewsWTW recommends policy changes to fuel UK economic growth

Plus: ABI calls on industry to put savers at the heart of plans to boost pension investment

-

Opinion Pieces

Opinion PiecesUK venture capital: spinning out for success

Academic research produces excellent technology and medical firms, but the funding is not always available to take things further

-

Features

FeaturesFixed income, rates & currency: US debt crisis averted – what next?

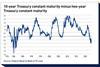

The US debt ceiling crisis was resolved in June, avoiding potentially major fireworks, with a suspension of the limit until early 2025. This ensures that the next time the politicians have to fight about it will be after the November 2024 presidential election. Although markets were relieved at the temporary resolution, the process of rebuilding the very depleted Treasury cash balances – with some huge bill auctions planned – will drain significant liquidity from the system, which could put pressure on the rates market.