All IPE articles in January 2024 (Magazine)

View all stories from this issue.

-

Country Report

Country ReportCEE country report 2024: Poland’s auto-enrolment system - five years on

Slow but steady progress in auto enrolment is driving growth in workplace pension assets and membership

-

Features

FeaturesIPE Quest Expectations Indicator - January 2024

It is safe to predict that 2024 will be a year of desperate campaigning. Political surprises in the US and UK are possible and, this time, they do make a difference to markets

-

Analysis

AnalysisSustainable finance: outlook and trends for 2024

Transition finance is expected to be one significant theme in 2024 as net-zero regulations come into force

-

Opinion Pieces

Opinion PiecesAgreement on Stability and Growth Pact spells Austerity reload

The reform of the Stability and Growth Pact (SGP) proposed by the European Commission (EC) in March 2023 had been criticised from all sides, but just before Christmas, European finance ministers agreed on new terms. The SGP had been suspended in response to the COVID-19 crisis but comes back into force in 2024.

-

Interviews

InterviewsInvestors poised to raise fixed-income allocations

European institutions discuss their strategies for fixed income, which is finally attracting capital as central banks reach the end of the hiking cycle

-

Book Review

Book ReviewBook review: The Financial Markets of Ancient Egypt – Risk and Return

“If men could learn from history, what lessons it might teach us. But passion and party blind our eyes.”

-

Opinion Pieces

Opinion PiecesAustralia's super funds strengthen their voice

A new superannuation advocacy body has been established in Australia. Known as the Super Members Council of Australia (SMC), it will become the voice of Australia’s rapidly-growing profit-to-members super funds.

-

Features

FeaturesWill delayed economic bad news hit the market this year?

Global economic growth was below potential in 2023, but still markedly stronger than the forecasts had been indicating at the start of the year, with the US leading the way and even the likes of Europe and the UK, though hardly stellar performers, posting better than expected economic activity.

-

Interviews

InterviewsBarings: A bond investor for changing times

Martin Horne is the new global head of public assets at Barings bond investor, but he is a bond guy through and through.

-

Asset Class Reports

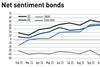

Asset Class ReportsFixed income: Investors put weight behind bond markets

Exposure to bonds is rising at the fastest rate since the financial crisis, as investors focus on high-quality paper and the shorter end of the yield curve

-

Opinion Pieces

Opinion PiecesIBM revives defined benefit pensions in the US

This January 2024 marks an important turning point in the US retirement industry. Technology giant IBM, which has always been seen as a bellwether of American business practices, is keeping its 401(k) plan, but will stop matching contributions of up to 6%.

-

Features

FeaturesNLP can help identify linkages between equity market peers

Natural language processing in AI provides a way to gain insights from unstructured data at scale, allowing access to information across a broad set of investment opportunities

-

Features

FeaturesNet zero’s bond index problem

The fixed-income space has not been short of sustainability innovations over the years.

-

Features

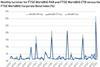

Insurance-linked securities wind brings good news for investors

In the two decades prior to 2022, the negative correlation between stock and treasury bond market returns has been a key driver of institutional investor portfolio construction. Fixed income allocations provided investors significant relief during equity market downturns and increased expected risk-adjusted returns for the popular 60/40 stock/bond portfolio.

-

Interviews

InterviewsGrégoire Haenni: How Switzerland’s CPEG is building resilience

Grégoire Haenni, CIO of CPEG, the public pension fund for the Swiss canton of Geneva, talks to Carlo Svaluto Moreolo about his views about markets and the fund’s sustainability journey

-

Country Report

Country ReportBulgaria’s pension funds look to Europe

The country’s pension sector is seeking greater flexibility in investment fund options

-

Opinion Pieces

Opinion PiecesPensions are instrumental in Europe’s unfinished capital markets project

This summer will mark 10 years since Jean-Claude Juncker, former EU Commission president, outlined a vision for a European Capital Markets Union (CMU) – a project both uncompleted and still acutely needed.

-

Country Report

Country ReportSecond-pillar pensions in Central & Eastern Europe

Assets, membership and asset allocation

-

Opinion Pieces

Opinion PiecesReasons to be cheerful in ESG-land

In 1979 Ian Dury, an influential British musician, released a song called ‘Reasons to be Cheerful, Pt 3’, which quickly became a classic. Let us consider why the world of environmental, social and governance (ESG) investing offers grounds for good cheer in the year ahead, even if it is not as rousing as the song.

-

Opinion Pieces

Opinion PiecesWhy DC pensions should choose private equity as first step into illiquids

Governments, regulators, central banks and even trustees are talking about illiquid investments and the productive economy. This is correctly driven by an underlying belief that illiquid assets can improve overall portfolio risk-adjusted returns. But most importantly, if defined contribution (DC) trustees are already keen to get behind productive finance, where do they start if they currently allocate nothing to illiquids?