Latest analysis – Page 15

-

Analysis

AnalysisMansion House Compact: spotlight on British Business Bank

When he introduced the Mansion House Compact in July 2023, the UK’s chancellor of the exchequer tasked the British Business Bank with establishing an investment vehicle to open its commercial capability and investment pipeline to pension investment

-

Analysis

AnalysisPension funds head towards new private equity cycle

Schemes navigate market correction, adjusting pricing expectations, looking for exits to reinvest in the asset class

-

Analysis

AnalysisCorporate governance battlegrounds at this year’s AGM season

Shareholders will use board elections to express their opinions on environmental issues

-

Opinion Pieces

Opinion PiecesCan pensions help with German skills crisis?

German companies consider the shortage of skilled workers as one of the biggest risks for the future of their business. According to market data portal Statista, 58% of firms see the lack of qualified workers putting operations at risk in the next few months, second only to the risks posed by energy and commodity prices (61%).

-

Opinion Pieces

Opinion PiecesUnder the spotlight: US pension plans and their use of leverage

Does US public pension funds’ use of borrowed money and derivatives pose systemic risks to global financial markets? That is the concern of global regulators, which have recently stepped up scrutiny of the practice, according to a recent article in the Financial Times (FT). But senior executives interviewed by IPE seem less worried.

-

Opinion Pieces

Opinion PiecesGreen champion to lead Australia’s Future Fund

Australia’s sovereign wealth fund, the Future Fund, which was designed to cover unfunded Federal government pension liabilities, is poised to “renew and refresh”, following the appointment of Greg Combet as its new chair from mid-2024.

-

Analysis

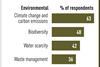

AnalysisESG mandates demand more from asset managers

Greater granularity in ESG investing is set to raise the bar for asset managers

-

Analysis

AnalysisMansion House Compact: spotlight on NEST

NEST joined the Mansion House Compact in July 2023 as one of the first signatories, committing to allocating at least 5% of its default funds to unlisted equities by 2030

-

Opinion Pieces

Opinion PiecesInterview: Elizabeth Fernando on NEST’s new thematic strategy

Sustainability focus underlines NEST’s growing importance as a UK institutional investor

-

Analysis

AnalysisEuropean disappointment as US strife shows up in manager CA100+ exits

Repercussions for mandates may be limited but beware any European asset manager thinking about treading the same path

-

Analysis

AnalysisBank of England right to scrutinise the role of funded reinsurance

Prudential Regulation Authority calls for limited exposure to reinsurance

-

Analysis

AnalysisMansion House Compact: spotlight on L&G

L&G joined the Mansion House Compact in July 2023 as one of the first signatories, committing to allocating at least 5% of its default funds to unlisted equities

-

Analysis

AnalysisTPR to be lobbied after new fiduciary duty, climate report

it is crucial that TPR adds the report’s key messages to its official guidelines, says Maria Nazarova-Doyle

-

Analysis

AnalysisNBIM needs much longer-term strategy and better communication, academic finds

Nicolai Tangen praised for SWF’s transparency in releasing the internal report on its organisational culture

-

News

NewsNBIM’s divestment decisions yield NOK10bn returns

‘There is still a way to go before we reach our goal of net zero targets and transition plans for all the companies in the portfolio,’ says Carine Smith Ihenacho

-

News

News2024 to be the biggest year for UK pension de-risking

WTW expects the pension risk transfer market to reach £80bn in 2024

-

Analysis

AnalysisEU capital markets face an uncertain future

The success of the European Union depends on developing its capital markets, but achieving integration faces political, cultural and technical challenges

-

Analysis

AnalysisThematic investing set to morph into impact investing

In the second article on a new survey, Vincent Mortier, Monica Defend and Amin Rajan argue that greater granularity in ESG investing is set to boost impact investing

-

Opinion Pieces

Opinion PiecesOpponents of Dutch pension reform can’t agree

The Dutch parliamentary elections of 22 November not only resulted in a historic victory for Geert Wilders. The record loss of the governing coalition also meant the new Pension Act no longer has majority support in parliament.

-

Opinion Pieces

Opinion PiecesGuaranteed retirement income and AI: key themes for the US in 2024

The three major 2024 trends in the US retirement industry, according to senior industry figures interviewed by IPE, are: Plan sponsors will continue to expand financial wellness programmes and explore optional provisions of the new pension law SECURE 2.0. Plan participants will up their demand for guaranteed income and ...