Latest from IPE Magazine – Page 21

-

Special Report

Special ReportFrance: Macron’s reforms look secure

President Macron’s pension reforms may have their detractors, but the hung parliament is not expected to roll back any of them significantly

-

Special Report

Special ReportGermany: Politicians look to bolster pensions ahead of elections

Draft bills prepared by the government to change public, private and occupational pensions are bound for parliamentary debate

-

Interviews

InterviewsKPN Pensioenfonds: Active investors by conviction

Caspar Vlaar and Jaap van Dam of KPN Pensioenfonds talk to Tjibbe Hoekstra about the Dutch fund’s belief in active investing, its venture into private markets and its impact strategy

-

Features

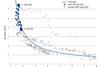

FeaturesSecondary markets and innovation boost private equity liquidity

Liquidity has reduced significantly in global private capital markets. Whilst private equity-backed IPOs are up this year, overall exit value is down by 66% and there is currently a large backlog of unsold assets, of which 40% are four years or older. The cumulative sum of unsold assets sits at $3.2trn (€2.9trn), according to Bain. Recent data from Preqin shows that capital called has exceeded capital distributed by $1.57trn since 2018, highlighting the lack of free capital in private markets.

-

Features

FeaturesFears grow of US slowdown

US president Joe Biden’s decision to step aside was much murmured about following his disastrous performance in a debate with Donald Trump, but it was still a surprise when he announced his decision. However, market reactions were relatively muted, despite shaking pollsters’ predictions on who might now win the election.

-

Analysis

AnalysisInvestment strategy: how one Dutch pension fund democratised its ESG process

Pensioenfonds Detailhandel’s groundbreaking attempt to democratise its investment process is just one development in this growing trend

-

Features

FeaturesChange is required as populations age

During a recent weekend in the artsy California mountain town of Idyllwild, my wife and I enjoyed a performance of a local band. Seated near us was a gentleman wearing a T-shirt proclaiming, We the People ARE PISSED OFF. The message on this shirt caught my attention.

-

Opinion Pieces

Opinion PiecesWhy we need to talk about the birthrate

If you live in a big city like London, and if you look hard enough, you are sure to find signs of a falling birthrate.

-

Opinion Pieces

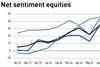

Opinion PiecesInstitutional investors shouldn't be so concerned about equity market concentration

Before the August 2024 equity sell-off, the rising level of concentration in global equity markets had many investors worried for some time, and concentration may well continue to be a feature of equity markets in the near future.

-

Interviews

InterviewsHSBC Asset Management puts team culture at the fore in growth strategy

It’s often said that timing is everything. Nicolas Moreau sees an element of luck in the timing of his appointment to the helm of HSBC Asset Management in September 2019. This gave him a six-month head start in his role as CEO by the time the COVID pandemic arrived in early 2020.

-

Interviews

InterviewsPension funds on euro fixed income: navigating the rate cycle

We asked pension funds in Spain, Germany and Finland about their current views on European fixed income and credit as the ECB looks carefully at the timing and sequence of its rate cuts

-

Features

FeaturesNAV finance takes hold as a niche form of private credit

Private equity investments are by their nature illiquid, which is why PE general partners (GPs) raising a new fund only call on the committed capital when it needs to be deployed in a new investment – and that may be up to a few years after the fund closes.

-

Features

FeaturesIPE Quest Expectations Indicator - September 2024

Kamala Harris’ candidacy has turned the political mood in the US. The two candidates are very close together in the polls but while Trump’s score is stable – except for a worsening favourability – Harris’ statistics all show a positive trend.

-

Opinion Pieces

Opinion PiecesDeep-tech startups: from academic know how to commercial viability

Many would argue that universities have been set up in the pursuit of knowledge for its own sake, so perhaps the idea of seeking commercial applications for university research detracts from the beauty of that ideal. That certainly was the attitude in Oxford when I completed my own doctorate in physics four decades ago. But times have changed and the UK, and Europe more generally, is desperate to encourage the growth of innovative companies that can rival those being churned out in the US.

-

Opinion Pieces

Opinion PiecesUS court scraps SEC private equity transparency rule

The US appeals court’s decision, last June, to throw out a Securities and Exchange Commission (SEC) rule intended to give investors more transparency into private funds has sparked a heated debate.

-

Opinion Pieces

Opinion PiecesGerman politicians pronounce on pensions policy ahead of next year's election

With federal elections likely to be held on 28 September next year, German politicians have started to reveal ideas on pensions.

-

Opinion Pieces

Opinion PiecesDanish politics focuses on the good life

Pensions and the labour market were the focus of end-of-summer political pronouncements in Denmark this year. If brought into action, some of the ideas could lead to forward-thinking changes to pensions.

-

Special Report

Special ReportIceland: New law opens up rental markets

Reforms will lead to fundamental changes in Icelandic pensions

-

Opinion Pieces

Opinion PiecesAustralia's super funds emerge from regulatory shadows

Australia’s A$700bn-plus (€424bn) retail superannuation sector is starting to emerge from the shadow of its profit-to-member peers. It has been only five years since a royal commission published damning evidence of misconduct within the sector.

-

Special Report

Special ReportIreland: Auto-enrolment slips to vaguer deadline

With a general election looming, there are concerns that workplace pensions will not be a priority