Latest from IPE Magazine – Page 16

-

Special Report

Special ReportLead plaintiff: Control, influence and accountability

Institutional investors are not known, historically, for being active investors, preferring instead to allow their long-term investment horizons to ride out any short-term blips.

-

Country Report

Country ReportDenmark: ATP boss stands by investment strategy in face of critics

Labour market fund CEO Martin Præstegaard: ‘Stick to current investment strategy but be open to change’

-

Special Report

Merseyside Pension Fund: Looking after one’s own benefits the wider economy

The £10bn (€12bn) Merseyside Pension Fund has long been recognised as an active asset owner that takes its responsibilities as a shareholder seriously.

-

Special Report

Special ReportInvestor litigation outside the US on the rise

Class-action lawsuits have been a staple of the litigation landscape in the US for decades, but this trend is now spreading, with investor litigation on the rise across the UK and Europe

-

Country Report

Country ReportSweden: Mixed opinions on AP funds merger

The main AP funds have expressed their opinions, with reservations, about the proposals to merge them from five entities to three

-

Country Report

Country ReportSweden's buffer fund AP4 considers doubling allocation to defensive equities

An overhaul of buffer fund’s dynamic normal portfolio is already under way in a bid to adapt to greater global uncertainty

-

Special Report

Special ReportUK group litigation funding: Devil in the detail

Third-party litigation funding (TPLF) has become a key ‘must-have’ for opt-in group litigation in Europe, but in July 2023 the UK Supreme Court made a ruling that potentially threw a spanner in the works for such funding used in UK lawsuits.

-

Country Report

Country ReportInterview: Tina Rönnholm, Erik Fransson, Fondtorgsnämnden (FTN)

FTN urges fund management companies to dedicate time and resources to its RFPs

-

Special Report

Special ReportSecurities litigation: the view from our institutional clients

Over the last year we have continued to see a steady stream of new group investor actions brought across Europe, arising from serious alleged governance failures.

-

Special Report

Special ReportWeighing the costs and benefits of making a claim

ABN-Amro, Airbus, ING, Petrobras and Stellantis are among the major corporations defending class action lawsuits in the Dutch courts. They are likely to be joined by Philips within the next 12 months.

-

Opinion Pieces

Opinion PiecesPreparedness: a new asset class?

Wars are famously costly. Most people would agree that preventing them is infinitely preferable to paying for them.

-

Opinion Pieces

Opinion PiecesThe private credit market needs careful monitoring

European institutional investors seem to be in a bind. Equities performed well this year, but market concentration remains at record levels and many investors expect a correction. Returns from bonds have been mostly positive, but that could change if inflation flares up again. The real estate market may be starting to recover, but it is early days, and the recovery may not be linear.

-

Analysis

AnalysisIf UK defined contribution is ‘broken’, could collective DC be the answer?

Collective DC is emerging in the UK but time will tell whether employers will embrace it

-

Interviews

InterviewsHow pension funds manage derivatives and liquidity needs

The use of derivatives, for hedging and other purposes, is common among pension funds, but it can be a drain on liquidity. We asked three pension funds how they ensure adequate levels of liquidity when interest rates are volatile

-

Interviews

InterviewsLeapFrog eyes global impact investment opportunities

Impact investing was once a niche concept. “We were seen as the weird people in the corner of the room,” recalls Andy Kuper, the South African founder and CEO of LeapFrog Investments

-

Features

FeaturesThe effect of behavioural biases on active investment portfolios

It has been become apparent in recent years that behavioural finance has important things to say about how investors make decisions.

-

Features

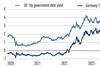

FeaturesFixed income, rates, currencies: All eyes on Trump’s return

With the Republican Party now in control of both Senate and House, the leeway that President-elect Donald Trump will have to enact his pre-election policies could be considerable.

-

Analysis

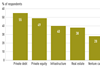

AnalysisNew research sees private markets investing entering a new era

New research charts the emerging and varied demands of private markets investors

-

Interviews

InterviewsHypoVereinsbank pension funds: Searching for sustainability in private markets

Markus Schmidt, director of asset management for the pension funds of Germany’s HVB, talks to Carlo Svaluto Moreolo about the schemes’ combination of strict liability and risk management with a broad growth portfolio and sustainability focus

-

Features

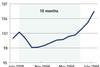

FeaturesInsurance-linked securities bank a stellar year for returns

Insurance-linked securities (ILS) may be complicated, but they are gaining an institutional following especially among pension and sovereign wealth funds, multi-asset investment firms and endowments.