Latest from IPE Magazine – Page 12

-

Opinion Pieces

Opinion PiecesGet dirt rich to save the earth: Soil as an asset class

Nature can provide almost 40% of greenhouse gas reductions needed by 2030, according to research published in 2017 by the Nature Conservancy.

-

Opinion Pieces

Opinion PiecesUK defined contribution pension schemes sign up to Mansion House II

Labour’s ‘Mansion House Accord’ has secured commitments from 17 of the largest workplace DC providers to invest 10% of their default funds into private markets by 2030, with 5% of the total allocated to the UK.

-

Opinion Pieces

Opinion PiecesBeyond the ESG backlash – what next for European asset owners?

The US asset management landscape is rapidly transforming, with a re-evaluation of investment priorities shaped by political pressure and regulatory change. For European asset owners this brings both uncertainty and a rare opportunity to achieve strategic clarity, provided they are willing to look beyond the short-term chaos.

-

Features

FeaturesCould white hydrogen solve the renewable energy challenge?

Discovery of a reserve of ‘white’ hydrogen could alter the dynamics of energy transition Hydrogen-focused ETFs have fared badly The gas can also serve as a hedge against geopolitical and energy security risks Production costs are higher than fossil fuel alternatives

-

Research

ResearchIPE institutional market survey: Small and mid cap equities managers 2025

The total assets invested in small and mid-cap equities by global managers increased by more than 13% last year, while the assets invested on behalf of European institutional investors fell by nearly 8%.

-

Research

ResearchIPE institutional market survey: Managers of UK institutional assets 2025

At the end of last year, global managers held €3.9trn of assets on behalf of UK institutional investors, in line with 2023. AUM growth was flat also for UK pension fund clients.

-

Interviews

InterviewsTPT’s quest to support UK DB pension schemes

Peter Smith, investment director at TPT, the consolidator of UK DB pension schemes, talks to Pamela Kokoszka about the latest developments in investment management at the organisation

-

Features

Fixed income, rates, currencies: Fickle US policy shakes global investor confidence

The hugely unpredictable policy announcements from those in charge of the world’s largest developed economy are market events more usually associated with goings-on in a newer EM economy

-

Features

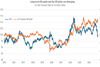

FeaturesChart watch: Uncertainty ripples across markets

The trade war unleashed by Trump’s tariffs and the knock-on effects for business confidence and commodities demand are reflected in our latest chart overview

-

Opinion Pieces

Opinion PiecesAustralian super funds split on US exposure post Trump tariffs

Just weeks after Australian super funds visited the United States to pitch investments worth hundreds of billions of dollars, US president Donald Trump delivered a body blow with his ‘Liberation Day’ tariff plan.

-

Country Report

Country ReportGermany country report 2025: New government faces choices on pensions reform

The collapse of Germany’s three-party coalition last year left behind a backlog of laws and proposals on pensions. What happens now?

-

Special Report

Special ReportPension and investment consultants: Business models are changing

Pension and investment consultants are adjusting business strategies in response to an increasingly complex and volatile investment environment

-

Special Report

Special ReportArtificial Intelligence: UK pension funds optimistic but wary as they dip into AI

Trustees are exploring AI but emphasise the importance of understanding risks such as data security and ethical considerations

-

Asset Class Reports

Asset Class ReportsPrivate credit turns evergreen as funds grow in number

As managers compete for scale and expand their footprint, the role of evergreen private credit funds is expected to grow

-

Asset Class Reports

Asset Class ReportsIs it time for private credit to step up on investing in artificial intelligence?

Besides digital and power infrastructure, investors are beginning to shift their focus to other areas of the burgeoning AI market

-

Country Report

Country ReportCan pension funds help German economy get back on its feet through investment in growth start-ups?

WIN, a government-sponsored initiative to boost investment in growth start-ups, has received widespread but not wholesale backing

-

Special Report

Asset managers test AI’s power in the investment process

The AI revolution has come to asset management. Five leaders overseeing its rollout examine the state of play

-

Country Report

Country ReportA long-term view on German institutional investment

A 10-year Spezialfonds analysis of German institutional funds highlights how significantly the institutional investment landscape has evolved

-

Special Report

Special ReportArtificial intelligence is transforming Asia’s financial sector

Asian markets are adopting AI at varying paces, but the potential for further development in the financial sector is significant, say experts

-

Asset Class Reports

Asset Class ReportsConsolidation in the private credit space points to a maturing phase

Recent M&A activity in private credit follows hot on the heels of a decade-long boom. Is there more to come?