Latest from IPE Magazine – Page 282

-

Features

Inflection point of emerging markets

In this article, the first in a series delving into a new study, Nick Lyster and Amin Rajan ask whether emerging markets are becoming yesterday’s story or are merely rebooting their growth engines before the next leap

-

Special Report

Pension Fund Governance: Avoid the bear traps

UK pension funds are increasing governance levels as they implement regulatory guidance on integrated risk management, says Pádraig Floyd. Professional trustees are playing a greater role

-

Asset Class Reports

Investment Grade Credit: Electronic liquidity taps open up

A recent paper from Pictet Asset Management paints a picture of fast-diminishing liquidity, but also some innovative responses. Martin Steward reports

-

Country Report

Switzerland: And now for the details

Switzerland’s AV2020 reform programme remains contentious and politically charged, according to Barbara Ottawa. But some are still holding out for a depoliticisation of the process

-

Features

Liability-Driven Investment: This sprint finish could get brutal

Things seem to have gone pretty well for UK pension schemes during 2013. A combination of rising bond yields and an equity market rally meant that, at the least, funding levels didn’t get any worse, and at best got schemes two or three percentage points closer to the finishing line.

-

Special Report

Risk and Portfolio Construction: Rates of change

To a large extent today the question of what to do in portfolio construction is really a question of what to do about interest rates.

-

Special Report

Special ReportTop 400: Global assets up 8.9% in 2013

M&A has featured highly in asset management in recent years. Until now, this has largely been dictated by external circumstances, such as bank parent companies seeking to increase capital adequacy or to abide by competition regulations.

-

Asset Class Reports

Asset Class ReportsDeveloped Market Sovereign Bonds: From ruin to recovery

Fundamentals, technicals and sentiment have come together to change the fortunes of peripheral euro-zone bonds. Joseph Mariathasan finds that, while these markets may never again be considered core, yield-hungry investors are happy to provide continuing support

-

Special Report

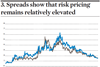

Risk and Portfolio Construction: A corner turned

The consensus is that 2012 saw the trough of the 30-year downdraft in interest rates. Daniel Ben-Ami tests the strength of this conviction and describes the scenarios that could threaten it

-

Special Report

Special ReportTop 400: The essential C-word in investment management

Mitesh Sheth defines 10 dimensions of an undervalued factor in investment management

-

Special Report

Risk and Portfolio Construction: From solo to tango

As the bond markets move from bullish to bearish, David Turner asks if we need new assumptions about asset class correlations

-

Special Report

Special ReportTop 400: Not so hasty: Keeping a manager when the going gets tough

Rick di Mascio argues that the decision about whether to sack an underperforming manager should be one that focuses on process, not just performance numbers

-

Special Report

Risk and Portfolio Construction: A new era for risk parity

Jennifer Bollen asks whether the end of the bond bull market signals the death of the traditional risk parity model

-

Special Report

Special ReportTop 400: Innovating in a world where winner takes all

A person who moves a mountain starts by taking away a small stone, according to a Chinese saying. This applies to the asset management industry today, say Amin Rajan and Kevin Pleiter

-

Special Report

Special ReportTop 400: Managers pursue rationalisation

Alastair Sewell and Erwin van Lumich believe that recent transactions are unlikely to herald widespread M&A among European asset managers but that rationalisation will continue

-

Special Report

Special ReportTop 400: Finance and regulation

Nitin Mehta believes professional bodies and well-run self-regulatory organisations can help buffer the sometimes competing priorities of regulators and the financial industry

-

Special Report

Special ReportTop 400: The burden of harmony

MIFID II and other European regulations are not as consistent as they seem, says Mike Ginnelly

-

Special Report

Special ReportTop 400: Are we doing this right? Are we doing this well?

Catherine Doherty looks at the mechanical and cultural work that investment managers are doing to improve their own businesses

-

Features

Another eventful summer

The Spanish Treasury joined the UK, Germany, France and Italy as the fifth European sovereign to issue inflation-linked bonds on 13 May, raising €5bn for 10-year paper that was four times oversubscribed.

-

Features

Put the trust back

Being outside the EU doesn’t mean you escape regulation. Swiss pension funds are complaining about excessive regulation – in this case, the burden is homemade and only to some extent fuelled by the financial crisis.