Latest from IPE Magazine – Page 34

-

Country Report

Country ReportFinland aims for pension stability

A pensions working group will investigate ways to improve the system to help strengthen the economy

-

Special Report

Special ReportUSS settlement with Petrobras and PWC Brazilian subsidiary

In February 2018, the Universities Superannuation Scheme (USS) reached a settlement with PWC’s Brazilian subsidiary as part of a class action lawsuit against Petrobras.

-

Country Report

Icelandic pension funds show readiness to face challenges

The proposed liquidation of Iceland’s Housing Finance Fund is the latest of a string of challenges for Icelandic pension funds

-

Special Report

Special ReportAP7 notches up legal success against Kraft Heinz

In May 2023, Sweden’s AP7 fund recorded a significant victory for Swedish and other investors when US food giant Kraft Heinz agreed to settle a class action lawsuit for $450m (€421m).

-

Special Report

Special ReportColorado fire and police settle with Cognizant

In August 2021, Fire and Police Pension Association Colorado (FPPA), alongside other plaintiffs, reached a settlement with Cognizant Technology Solutions Corporation for $95m (€88.7m).

-

Special Report

Special ReportBuilding a class action toolbox for investors

As class actions have started to play an increasingly important role in good governance for UK and European pensions funds, the need to establish best practice in the field is growing.

-

Analysis

AnalysisIreland’s new sovereign wealth fund

The planned Future Ireland Fund (FIF) aims to cover expected future costs such as pensions and healthcare

-

Opinion Pieces

Opinion PiecesSecurities litigation can be worth the effort

Pension funds and other institutional investors face an uphill challenge when it comes to managing their investor action responsibilities.

-

Interviews

InterviewsBenefits of travelling together in pensions: Wyn Francis’s journey from BT to Brightwell

Wyn Francis, CIO of Brightwell, talks to Carlo Svaluto Moreolo about the new phase of development for the organisation

-

Interviews

InterviewsFiera Capital: Montreal’s succession story

If Fiera Capital were a retail store it might need a big shop window. It is perhaps better known in the institutional world outside Canada for strategies like real assets but Fiera is a full-service asset manager that is also a big deal in its home town of Montreal.

-

Features

FeaturesIs the US economy finally heading for a soft landing?

Having come to terms with the higher-for-longer mantra, markets are grappling with ‘higher-for-even-longer’, as US economic resilience continues to challenge expectations of weakness while reducing the prospects for earlier interest rate cuts from the Federal Reserve.

-

Features

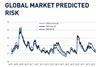

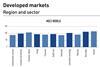

FeaturesQontigo Riskwatch – December 2023

*Data as of 31 October 2023. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Opinion Pieces

Opinion PiecesWill social partners carve a new role for themselves in pensions?

Social partnership can mean different things in many countries, or very little at all in others. The concept resonates most in continental Europe, where a tripartite framework of social-market capitalism has taken root since the second world war, in which corporatist decision-making involving government, labour and employer voices is entrenched.

-

Features

FeaturesThe great desyncronisation age in global financial markets

Investors are witnesses to the end of an era of synchronised global growth, when China could be counted on for outsized expansion that provided a broad cross-border lift for economies, industries and asset classes.

-

Interviews

InterviewsPension funds ride out the macro uncertainty

European institutions reflect on their priorities for 2024, as the fundamental questions about inflation and the impact of higher interest rates remain unanswered

-

Opinion Pieces

Opinion PiecesInvestors should focus on debt sustainability

The good news for institutional investors as 2024 approaches is that central banks seem to have accomplished something remarkable. Inflation is falling in the US and Europe after rising to levels not seen for decades, thanks to what have been among the fastest and sharpest rate hikes. Economic growth has held up, at least in the US. Many economists expect a soft landing there, and a mild recession in Europe.

-

Features

FeaturesAvoided emissions: measuring carbon that didn’t enter the atmosphere

A few years ago, a footwear producer’s claim that it was reducing carbon emissions in the economy because its customers walked rather than took the car provoked amusement among investment managers. It wanted to prove its product was healthier and greener than competing transport modes by claiming credit for emissions prevented from petrol use. This autumn, assessments of the role played by individual low-carbon products in replacing fossil fuels are again under scrutiny in the finance sector.

-

Features

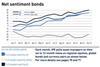

FeaturesIPE Quest Expectations Indicator - December 2023

IPE’s monthly poll of market sentiment, asking 50 asset managers about their six to 12-month views on regional equities, global bonds and currency pairs

-

Opinion Pieces

Opinion PiecesInvestors could do more to boost German start-ups

The German constitutional court’s ruling that the government’s reallocation of €60bn worth of debt to the country’s Climate and Transformation Fund is unlawful was a blow. But there was also also some welcome news last month.