Latest from IPE Magazine – Page 31

-

Asset Class Reports

Asset Class ReportsUK equities fail to regain their shine

UK pension funds are abandoning domestic equities, and the country’s global weighting in indices has also declined significantly

-

Special Report

Special ReportAllianzGI partners with DBR to offer pension risk transfer

A new joint venture allows corporates to offload pension obligations to an innovative corporate structure

-

Country Report

Country ReportViewpoint: Irish pension trustees must heed employer covenant

Sponsors can do more to secure DB member benefits

-

Country Report

Country ReportViewpoint: Ireland’s pension priorities for 2024

The country’s retirement landscape is changing fast

-

Country Report

Country ReportISIF: Impact investment fund with a difference

The Ireland Strategic Investment Fund’s focus is on driving the sustainable development of the Irish economy

-

Opinion Pieces

Opinion PiecesEurope (still) needs pension capital

The pressure on pension funds to invest in domestic assets never fades. Certain countries, notably in Northern Europe, have dealt with it better, for historical and cultural reasons.

-

Opinion Pieces

Opinion PiecesCross-border pensions: a better taxation model

When members of the European Union accession generation from central and eastern European (CEE) countries were young they used to dream of visiting Santa Claus in Lapland. As travel abroad was not permitted and communications were not developed, they wrote letters and waited impatiently for their presents to arrive.

-

Features

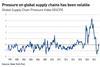

FeaturesConflict and elections set to dominate the investor landscape

Middle Eastern tensions are running high, with violence flaring up across the wider region. Combined with the ongoing attritional destruction in Ukraine, this is impacting world trade, and it seems certain that international conflict will continue to be a source of great concern in 2024.

-

Interviews

InterviewsPension funds hold on to their equities

European pension funds are looking to maintain their equity allocations, despite an uncertain outlook for global growth

-

Features

FeaturesMiFID II reforms: Bye bye unbundling?

A key part of the 2018 MiFID II package, the requirement to unbundle research from execution costs shook up the European asset management industry and changed the relationship between investment managers and their clients.

-

Opinion Pieces

Opinion PiecesCorporate pensions: a close eye on yields in 2024

The final two months of 2023 saw a return to form for global fixed income and equities, with respectable single and double-digit numbers in each case. After a false start in early 2023, at least for a multitude of asset forecasters, bonds were finally back in the final months of last year.

-

Analysis

AnalysisEU capital markets face an uncertain future

The success of the European Union depends on developing its capital markets, but achieving integration faces political, cultural and technical challenges

-

Analysis

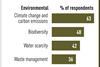

AnalysisThematic investing set to morph into impact investing

In the second article on a new survey, Vincent Mortier, Monica Defend and Amin Rajan argue that greater granularity in ESG investing is set to boost impact investing

-

Features

FeaturesRefining how factors impact investment returns

Investment management has undergone a significant transformation with the introduction of environmental, social and governance (ESG) investing. It emphasises a more holistic approach that goes beyond financial returns to assess long-term sustainability.

-

Interviews

InterviewsSystematic trading for long-term investors

Man Group, the investment management company listed on the London Stock Exchange since 1994, was founded in the City of London in 1783 by James Man as a sugar brokerage firm.

-

Features

FeaturesIPE Quest Expectations Indicator - February 2024

IPE’s monthly poll of market sentiment, asking 50 asset managers about their six to 12-month views on regional equities, global bonds and currency pairs

-

Opinion Pieces

Opinion PiecesOpponents of Dutch pension reform can’t agree

The Dutch parliamentary elections of 22 November not only resulted in a historic victory for Geert Wilders. The record loss of the governing coalition also meant the new Pension Act no longer has majority support in parliament.

-

Opinion Pieces

Opinion PiecesGuaranteed retirement income and AI: key themes for the US in 2024

The three major 2024 trends in the US retirement industry, according to senior industry figures interviewed by IPE, are: Plan sponsors will continue to expand financial wellness programmes and explore optional provisions of the new pension law SECURE 2.0. Plan participants will up their demand for guaranteed income and ...

-

Opinion Pieces

Opinion PiecesAustralian funds jostle for slice of energy transition market

Australia’s largest integrated power generator and energy retailer, Origin, lost out on becoming a cornerstone investment in the US$15bn (€13.7bn) Brookfield Global Transition Fund after a failed A$20bn (€12.2bn) attempt by a Brookfield-led consortium to take over Origin last year.

-

Opinion Pieces

Opinion PiecesMansion House reforms: UK government should embrace long-term thinking to boost the economy

Other countries have been far better than the UK at creating long-term strategies that have been maintained way beyond the five-year or shorter electoral timescales on which UK politicians focus