All IPE articles in May 2021 (Magazine)

View all stories from this issue.

-

Opinion Pieces

Opinion PiecesGuest Viewpoint: Pension funds are key to the recovery from COVID-19

The unprecedented situation resulting from the COVID-19 pandemic has shown that pension funds serve a key social function in supporting economies and citizens, ensuring benefits for old age income.

-

Country Report

Country ReportCountry Report – Pensions in UK (May 2021)

The UK’s Pension Schemes Act was finally signed in February 2021, after nearly two years of negotiations in parliament that were severely disrupted by elections, Brexit-related negotiations and the COVID-19 pandemic. The new rules have given the Pensions Regulator (TPR) new powers that could see it intervene in corporate actions such as mergers and acquisitions, as we analyse in this report. The report also looks at other key topics impacting the UK pensions sector, including DB funding, climate change, risk management and pension dashboards.

-

Special Report

Special ReportSpecial Report – Impact investing 2021

In this special report, we take a close look at how COVID-19 has impacted progress regarding SDGs and other key topics in impact investing including blended finance, impact bonds, social enterprises and ocean finance

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - May 2021

COVID-19 infection rates are still rising in the US and Japan, hopefully on the verge of decreasing in the EU and low in the UK. The positive trend in global infection rates is more than undone by a strong rise in infections in parts of Asia. With the exception of the UK and Israel, vaccination has not progressed to the stage where it has a discernible influence on infection rates.

-

Special Report

Ocean finance: The $24trn ‘blue’ economy

Ocean-focused investment funds are piquing investor interest as awareness of the importance of maritime ecology increases

-

Opinion Pieces

Opinion PiecesAbundant opportunity… and risk

In case you needed reminding, both China’s equity and fixed-income markets are the world’s second-largest after the US.

-

Features

FeaturesActive management: More than just a stopped clock

When most active managers underperform, how can investors identify the few who are likely to consistently outperform?

-

Opinion Pieces

Opinion PiecesAfrica offers Europe opportunities

In 2015, Europe faced the prospect of a million Syrian refugees fleeing from civil war, attempting to cross into its borders. The sudden influx created a political as well as a humanitarian crisis with Hungary building a 175km-long fence to prevent crossings from the Balkans.

-

Features

FeaturesAhead of the curve: Occupation could trump sex

There remains a great deal of popular debate about such things as the sex-linked glass ceiling, cliff, escalator and the ‘sticky’ floor, all of which imply that career opportunities are different for men and women.

-

Opinion Pieces

Opinion PiecesLetter from US: Aid without reform set to resolve the multi-employer pension plan crisis

Until March, The prospective collapse of multi-employer pension plans meant that over one million retired truck drivers, shop assistants, builders and other members of 186 schemes were at risk of losing their retirement benefits.

-

Asset Class Reports

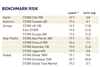

Asset Class ReportsAsset allocation: More factors to consider

COVID-19 has added a further blow to a decade of factor investing underperformance and highlighted the increasing impact of ESG

-

Asset Class Reports

Asset Class ReportsBrazil’s allure defies negative signals

Latin America’s largest economy continues to hold the interest of investors despite its poor showing on COVID, the economy and politics

-

Asset Class Reports

Asset Class ReportsEM outlook: Opportunities amid uncertainties

The pandemic has greatly affected emerging markets but while some are in a bad state others are showing great resilience

-

Interviews

InterviewsInterview: Amlan Roy, Head of Global Macro Research, SSGA

Amlan Roy holds no truck with the popular view of demography that most readers will recognise. That is the oversimplified model that focuses on an ageing population placing an intolerable burden on the public finances

-

Features

FeaturesPerspective: APG & E Fund in China

APG’s partnership with E Fund Management has produced tangible results

-

Asset Class Reports

Asset Class ReportsAsset class report – Emerging market equities

The pandemic has substantially altered the landscape for emerging markets. While some countries have contained its effect better than any developed market, others have been devastated. How should investors regard the impact of COVID-19 in their decision-making on future increases on allocations to emerging markets? In this report, we analyse the outlook for the asset class in general, and find out why Brazil continues to hold the interest of investors.

-

Opinion Pieces

Opinion PiecesLetter from Australia: A question of gender imbalance

Statistics offer a snapshot into the real world and they reveal a depressing picture of gender inequality in Australia’s superannuation system.

-

Asset Class Reports

Asset Class ReportsESG: Avoid sustainable equity exposure pitfalls

ESG strategies can introduce unintended factor biases, which can affect overall risk-return objectives if not managed correctly