All IPE articles in May 2021 (Magazine) – Page 2

-

Interviews

InterviewsHow we run our money: Bayer-Pensionskasse

Stefan Nellshen (pictured), CEO of the Bayer-Pensionskasse, tells Carlo Svaluto Moreolo about the fund’s ALM approach

-

Special Report

SDG reporting: Beyond SDG-washing

Only thorough processes and due diligence can make sense of the welter of claims and frameworks by companies using the SDGs as a reporting tool

-

Special Report

Special ReportMaking more of blended finance

Net-zero asset owners are trying to encourage larger asset managers to develop blended finance solutions at scale

-

Special Report

Blended finance: Institutional opportunity?

Unlocking institutional capital for blended finance will require a thorough understanding of the long-term requirements of investors

-

Features

FeaturesLong term matters: Is your board colluding with E(rratic) S(uperficial) G(reenwash)?

ESG is booming, but the industry risks becoming complacent. Fund managers are creating new products that meet markets’ needs more than those of society and the thin ‘layer’ of ESG in core investment processes is not contributing to the much-needed transformation of our economies and societies.

-

Special Report

Special ReportImpact bonds: Clipping the impact coupon

High risk, costs and complexity have hindered the development of impact bonds. Could this be about to change?

-

Book Review

Book ReviewBook review: Shooting for the moon

Mariana Mazzucato calls on us to reformulate capitalism itself, and to return to the ‘Big Government’ rejected by the baby-boomer generation

-

Features

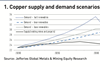

FeaturesNet-zero opportunities: Global green momentum boosts prospect of a mining super cycle

The Covid-19 pandemic has given everyone pause for thought. It has also been a catalyst for action. For some, global warming seemed like a nebulous, distant concern. But the fragility of life on earth has been laid bare.

-

Opinion Pieces

Opinion PiecesOECD: plans to mobilise institutional capital

The OECD is committed to facilitating development finance through structures that provide a commercial return

-

Interviews

InterviewsStrategically Speaking: Cardano

The central argument of the 2015 documentary ‘Boom, bust, boom’, which features several high-profile experts including Nobel laureates Paul Krugman, Robert Shiller and Daniel Kahneman, is that financial crises are natural events caused by human nature.

-

Special Report

Special ReportThe scaling up challenge

With ample diagnosis that the world is not on track to realise the UN’s 17 Sustainable Development Goals by their target of 2030, and a significant setback in the coronavirus pandemic, what can institutional investors and asset managers do to scale up impact-related capital?

-

Country Report

Country ReportClimate risk: Climate of change

Pension schemes will have to adjust their systems to cope with new regulations to tackle climate change

-

Country Report

Country ReportPension dashboards – a need for clarity

Dashboards hold out the promise of allowing individuals to see all their retirement savings on one digital platform

-

Country Report

Country ReportFunding code: Deciphering the new code

With the Pensions Regulator consulting on a new code of practice for defined benefit (DB) scheme funding, trustees are advised to take a long-term view of investment, covenant and liabilities

-

Country Report

Country ReportCommentary: A complex journey to net zero

Tackling climate change successfully is not just a matter of following rules. It is a continuum that trustees must embrace

-

Special Report

Special ReportCOVID’s legacy: making an impact towards a just transition

An initial narrow focus by investors on the social consequences of the pandemic has shifted to a more holistic perspective and a recognition that it affects all of the SDGs

-

Features

FeaturesFixed Income, Rates, Currencies: A false start

While we may be approaching that ‘exit from pandemic’ moment, the exceptional monetary and fiscal responses from policymakers ensure COVID-19’s economic legacy will be felt globally for years to come.

-

Country Report

Country ReportDB funding – a mixed recovery story

Last year brought both operational and financial challenges for defined benefit schemes but some have come out looking better for it

-

Country Report

Country ReportM&A: Regulator set to scrutinise more deals

New tools granted to the Pensions Regulator could see it play a more prominent role in corporate activity such as mergers and acquisitions (M&A)

-

Asset Class Reports

Asset Class ReportsEM equity outlook resilient despite gloom

There is less difference between apparently conflicting expert views on the prospects for emerging markets than first appears

- Previous Page

- Page1

- Page2

- Page3

- Next Page