More comment – Page 27

-

Opinion Pieces

Opinion PiecesFX Reserves: The ‘rainy day’ has arrived

The world is facing a short-term health and economic crisis with COVID-19. In the longer term it is threatened by an existential crisis with global warming caused by burning fossil fuels.

-

Opinion Pieces

Opinion PiecesLetter from US: COVID and racial justice to the fore

The 2021 proxy season’s hot issues are human capital management related to COVID-19 and social justice. Several large US public pension funds are at the forefront of these campaigns together with non-profit shareholder advocacy organisations like the Interfaith Center on Corporate Responsibility (ICCR) and As You Sow, a non-profit foundation that promotes corporate accountability.

-

Opinion Pieces

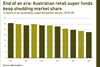

Opinion PiecesLetter from Australia: Retail super funds in distress

Australia’s once-dominant retail super funds are witnessing the end of an era as they wrestle with loss of consumer confidence in their brands. Hastening change has been the rise of industry supers, which benefitted from damaging evidence provided to the Hayne Royal Commission in 2018.

-

Opinion Pieces

Opinion PiecesViewpoint: PE must work towards measuring impact of sustainable investing

While EU regulation is a positive development, which will bring greater standardisation to ESG reporting, investors, organisations and regulators must aim to go further

-

Opinion Pieces

Opinion PiecesInfra must adapt to meet pension goals

Looked at collectively, or even individually, the cashflow needs of Europe’s defined benefit (DB) and hybrid pension schemes are huge and potentially challenging given the scale of income generating assets needed to help service them.

-

Opinion Pieces

Opinion PiecesThe world is approaching an inflection point

Domestic challenges and US political developments have proved such a preoccupation recently that it has been all too easy to miss a key global shift. China’s rise to global prominence has accelerated markedly as a result of the past year’s events.

-

Opinion Pieces

Opinion PiecesCOVID-19 barely tested the financial system

The financial system seems to have coped well with COVID-19. This is despite the repeated recent warnings about a build-up of systemic risk. In turn this has been linked to the abundance of cheap debt and the growth of the asset management industry.

-

Opinion Pieces

Opinion Pieces‘Close contact’ needed amid pandemic

Multiple lockdown restrictions have brought about a simpler way of working for some – remotely from home for most – but for institutional investors it also meant coming up with strategic models that could maintain the quality of asset managers’ due diligence – existing or potential.

-

Opinion Pieces

Opinion PiecesThe pandemic end-game

Overcoming COVID-19 and ensuring no recurrence is proving to be a formidable challenge for the global economy. The worst may still lie ahead. Even health systems in developed markets are creaking at the seams with the second and third waves of the pandemic. More transmissible mutations of the virus are making the task even harder.

-

Opinion Pieces

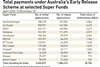

Opinion PiecesLetter from Australia: Early access genie escapes the bottle

In March 2020, as the Australian economy went into COVID-19 lockdown the government unlocked the national superannuation pool, seeking to ease the financial stress on individuals.

-

Opinion Pieces

Opinion PiecesLetter from US: HSAs set to build on popularity

The Health Savings Account (HSA) is becoming increasingly popular as a retirement savings vehicle in the US. The new Biden presidency and the now Democrat controlled Congress are likely to accentuate this trend in 2021 and beyond.

-

Opinion Pieces

Opinion PiecesGuest viewpoint: David Neal, IFM Investors

While COVID-19 continues to hit the global economy, governments are looking to infrastructure as a way to create future employment and sustain the eventual economic recovery

-

Opinion Pieces

Opinion PiecesViewpoint: Making the case for SDG-aligned investing

Mirtha Kastrapeli, founder and CEO of Beyond Alpha, makes a case for shifting to SDG-based systems investing

-

Opinion Pieces

Opinion PiecesViewpoint: Long-term lenders ideally placed to drive ESG conversations

With the world facing considerable and pressing environmental and social problems, the investment world has a critical role to play in addressing issues such as climate change, inequality and discrimination

-

Opinion Pieces

Opinion PiecesViewpoint: Blended finance and impact

Delivering the 2030 Agenda in the COVID-19 era and beyond

-

Opinion Pieces

Opinion PiecesSocial purpose: the new dimension

Investors’ attention turned to human capital issues in 2020 as COVID-19 took hold – including the treatment of staff and other stakeholders, as well as dividend policy and executive pay in cases where companies have received taxpayer support.upport.

-

Opinion Pieces

Opinion PiecesJapan is not that different

One of the abiding myths about Japan is that it is different from everywhere else. Not just distinctive in the sense that all countries have peculiarities but uniquely different.

-

Opinion Pieces

Opinion PiecesThe real meaning of engagement

Empirical evidence suggests that individuals are unengaged with DC pensions. This is demonstrated by the vast majority of DC members remaining in default funds and reluctant to increase contributions.

-

Opinion Pieces

Opinion PiecesUncertain conditions call for a steady course

The impact of COVID-19 has made long-term strategies that embrace resilience a high priority for pension funds to ensure there is a smoother ride during turbulent times.

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Jesper Kirstein

In recent months, the asset management industry has been dominated by adjustments inspired by the COVID-19 pandemic. This article will try to look beyond this and address the question of where the asset management industry is moving in the medium to long term.