Shareholders are throwing their weight behind requests relating to artificial intelligence (AI), despite backing away from most other environmental and social topics at this year’s annual general meetings (AGMs).

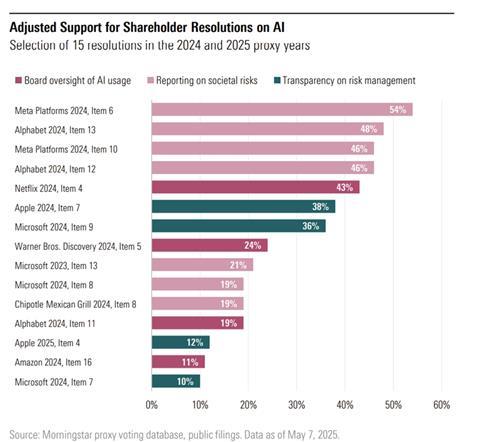

A research paper published by Morningstar examines how investors voted on 15 proposals tabled so far in the 2024 and 2025 proxy years, all addressing how US-listed companies are managing and reporting on their use of AI.

The pool of asset managers assessed included 20 from the US and 15 from across Europe.

“On average, shareholder support for resolutions on AI has exceeded support for proposals on other environmental and social themes,” Morningstar noted, adding that average adjusted support for the 15 requests was 30% – almost double the 16% garnered by the 400 environmental and social resolutions that went to vote in 2024.

Most of the proposals (12 out of the 15) were filed at just five companies: Alphabet, Amazon, Apple, Meta Platforms and Microsoft. The remaining three were tabled at Chipotle Mexican Grill, Netflix and Warner Bros Discovery.

The four most successful were at Meta and Alphabet, and focused on misinformation and disinformation, and AI-driven targeted advertising.

More than three quarters (75%) of European asset managers in the study supported the resolutions, on average, compared with just 30% of those in the US.

BlackRock supported just one of the 15 proposals, while State Street and Vanguard did not support any. Of the 15, Allianz Global Investors, Amundi, Candriam and Nordea supported every one they voted on.

According to Morningstar, the asset managers that backed proposals calling for more disclosures on AI issues often cited the value of transparency to help them better understand relevant material risks at a portfolio company.

In instances in which they supported requests for board oversight of AI, their voting rationales commonly argued the proposal would improve the oversight of such risks.

Those who voted against the proposals tended to say they were already satisfied with the information they had access to, they thought the company was managing the risks sufficiently, or that the proposal was too prescriptive.

Read the digital edition of IPE’s latest magazine