Amundi has finalised the acquisition of 100% of Sabadell Asset Management, six months after it announced the planned take-over in January.

Banco Sabadell and Amundi have also signed a 10-year distribution agreement, which Amundi said was getting off to a successful start.

“The integration and cooperation workflows launched between Banco Sabadell and Amundi since January confirm the partnership’s strong potential, as illustrated by the fact that the first products managed by Amundi are already being promoted within the Banco Sabadell retail network,” said Amundi.

Sabadell AM had assets under management of €21bn as at the end of May.

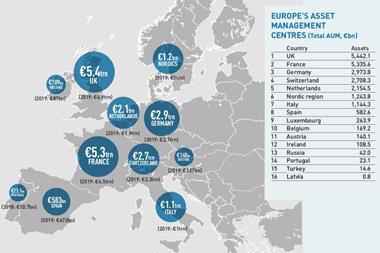

Amundi’s intention is for the acquisition and the partnership with Banco Sabadell to significantly reinforce its position in Spain and “to consolidate its European leadership while deploying its unique business model aimed at serving retail networks”.

Fitch Ratings previously said the distribution agreement with Sabadell was significant as the Spanish asset management market is dominated by retail investors that source investment products largely from the banking networks.

Yves Perrier, CEO of Amundi, said: “We are convinced that this new growth driver offers a solid potential for development. This partnership is in line with Amundi’s strategy in Europe to deliver its capabilities and resources to serve customers through retail networks.”

The acquisition of Sabadell Asset Management excludes Urquijo Gestion, and Sabadell Asset Management and Amundi Iberia are to remain two separate legal entities.

Amundi is the sixth largest manager of European institutional assets, according to IPE Top 500 data, with €398bn in the relevant assets under management as at the end of December 2019. Taking all businesses into account, it had €1.6trn in assets under management at the end of the year.

According to data provided to IPE for its Top 500 publication, Sabadell AM had €32.9bn in assets under management at the end of December.