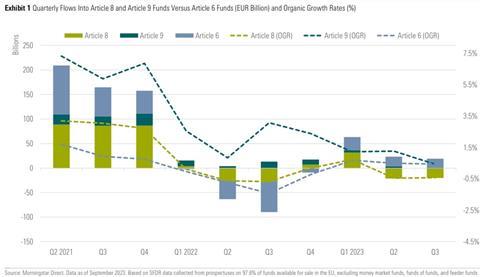

Article 8 funds continued bleeding money amid persistent macroeconomic pressures, according to Morningstar’s Q3 2023 in review report. Investors withdrew €20.5bn in the third quarter after redeeming €21.5bn in the previous quarter. Funds with no commitment to sustainable investments were disproportionately affected, it added.

The redemptions in the last three months disproportionally affected the Article 8 funds with no commitment to sustainable investments as these registered outflows of €13bn, representing almost 60% of the total Article 8 outflows over the period, while accounting for only one third of the Article 8 fund assets.

In contrast, Article 6 products continued gathering net new money, though the inflow momentum softened a bit, to €17.8bn from the restated €19.8bn in the previous quarter, Morningstar stated.

Meanwhile, inflows into Article 9 products shrunk to €1.4bn, from the restated €3.7bn in the second quarter. It represents the lowest level of subscriptions for Article 9 funds since the introduction of the Sustainable Finance Disclosure Regulation (SFDR) in March 2021.

The dwindling inflows can be attributed to a combination of economic and regulatory factors, including the great reclassification between the last quarter of 2022 and the first quarter of 2023.

Around 350 Article 9 funds were repositioned to the Article 8 category following the European Securities and Markets Authority’s (ESMA) clarification of the European Commision’s June 2021 Q&A last summer.

It specified that funds making Article 9 disclosures should hold only sustainable investments, except for cash and assets used for hedging purposes.

Earlier in the year ESMA issued a greenwashing warning to investors, in its report on Trends, Risks and Vulnerabilities, discussing one of the biggest challenges for the SFDR – its use as a label.

Last month the European Commission launched a consultation on the future of the EU’s SFDR, floating the possibility of “the distinction between the current Articles 8 and 9” disappearing from the transparency framework as part of a move to a sustainability product categorisation scheme.

Hortense Bioy, global director of sustainability research at Morningstar, said: “Two and a half years after SFDR came into force, and despite the challenging macroeconomic and regulatory environment, asset managers continued to shape their offerings around the regulation, upgrade funds to Article 8, and commit to more sustainable investments. With the new SFDR consultation launched by the EC in September, we can expect more uncertainty ahead.”

Assets shrank

Assets in Article 8 and Article 9 funds shrank by 1.3% over the third quarter of 2023, driven mostly by market depreciation and, to a lesser extent, the redemptions from Article 8 products, the Morningstar report revealed.

Article 6 fund assets also decreased by 3.3.% over the period. The previous quarter saw Article 6 fund assets surpass the asset growth rate of Article 8 and Article 9 funds for the first time since the enactment of SFDR in March 2021.

Article 8 and Article 9 fund assets managed to grasp the €5trn milestone, reaching just below €5bn at the end of September from the restated €5.1trn at the end of June. The two fund groups accounted for a constant share of the EU universe of 56.4%.

Despite the continued redemptions, Morningstar said, Article 8 funds maintained their market share at around 53% at the end of September. Assets in Article 9 funds slid by almost 4% to €301bn from last quarter’s €313bn. However, the share of Article 9 product stayed at 3.4%, showing trivial change compared with the previous quarter.

Read the digital edition of IPE’s latest magazine